Library:Imperialism in the Twenty-First Century: Difference between revisions

More languages

More actions

(Created page with "{{DISPLAYTITLE:''Imperialism in the Twenty-First Century'' (John Smith)}} https://cloudflare-ipfs.com/ipfs/bafykbzacebnahnt45yj34sh2urm5qd2bkdov3dwsec2tbpn3x5kbjyj4sqy6s?filename=John%20Smith%20-%20Imperialism%20in%20the%20Twenty-First%20Century_%20Globalization%2C%20Super-Exploitation%2C%20and%20Capitalism%E2%80%99s%20Final%20Crisis-Monthly%20Review%20Press%20%282016%29.pdf Category:Library works about imperialism Category:Empty library pages") Tag: Visual edit |

mNo edit summary |

||

| (9 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{ | {{Library work|title=Imperialism in the Twenty-First Century: Globalization, Super-Exploitation, and Capitalism's Final Crisis|author=John Charles Smith|publisher=Monthly Review Press|published_date=2016|published_location=New York City}} | ||

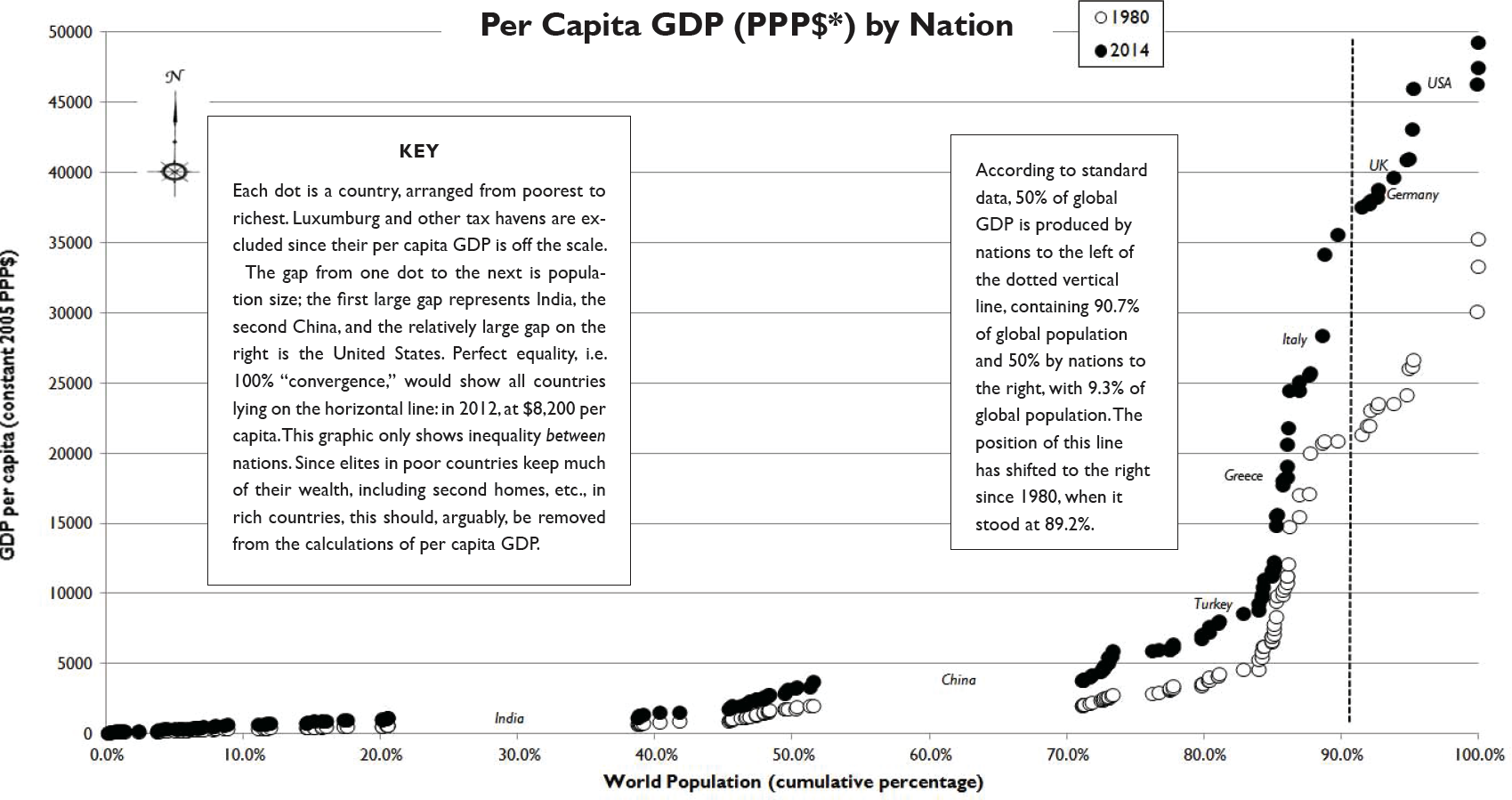

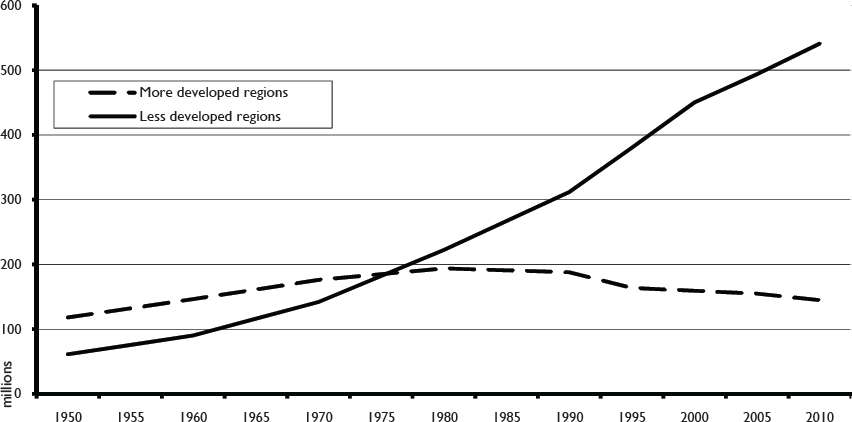

[[File:Per capita GDP by country.png|thumb|393x393px|Source: World Bank, World Development Indicators.]] | |||

== The Global Commodity == | |||

The collapse of Rana Plaza, an eight-story building housing several textile factories, a bank, and some shops in an industrial district north of Dhaka, Bangladesh's capital, on 24 April 2013, killing 1,133 garment workers and wounding 2,500, was one of the worst workplace disasters in recorded history.2 This disaster, and garment workers' grief, rage, and demands for justice, stirred feelings of sympathy and solidarity from working people around the world—and a frantic damage-limitation exercise by the giant corporations that rely on Bangladeshi factories for their products yet deny any responsibility for the atrocious wages, living, and working conditions of those who produce all their stuff. Adding to the sense of outrage felt by many is the fact that, the day before, cracks had opened up in the building's structure and an initial inspection resulted in its evacuation and a recommendation that it remain closed. Next morning a bank and shops on the ground floor obeyed this advice, but thousands of garment workers were ordered back to work on pain of dismissal. When generators illegally installed on the top floor were started up the building collapsed. Jyrki Raina, general secretary of IndustriALL, an international union federation, called it "mass industrial slaughter." | |||

The screams of thousands trapped and crushed as concrete and machinery cascaded down upon them unleashed a full-spectrum shockwave, amplified by the anguished howl of millions around the world. The calamity made instant headline news. Consumers of clothes made in Bangladesh's garment factories were confronted by their palpable connection to the people whose hands made their clothes, and about their miserable existence on this earth. Like an intense x-ray beam, the shock-wave from Rana Plaza lit up the internal structure of the global economy, throwing into sharp relief a fundamental fact about global capitalism that is normally kept out of sight and mind: its good health rests on extreme rates of exploitation of workers in the low-wage countries where production of consumer goods and intermediate inputs has been relocated. The attention of the world was drawn in particular to Bangladesh's poverty wages—the lowest factory wages of any major exporter in the world, even after a 77 percent pay increase in November 2013; to its death-trap factories—just five months earlier a fire at nearby Tazreen Fashions killed 112 workers, who were trapped behind barred windows and locked doors while working long into the night; to the violent suppression of union rights—union activists are routinely blacklisted, beaten up, and subject to arbitrary arrest; and to the incestuous relations between factory owners, politicians, and police chiefs in Bangladesh—no employer in Bangladesh's garment industry has ever been convicted of an infringement of health and safety laws.3 What makes all of it particularly relevant to this study is that the garment industry is "the quintessential example of a buyer-driven commodity chain … [where] global buyers determine what is to be produced, where, by whom, and at what price."4 As such, Bangladesh's garment industry distils the export-oriented industrialization strategy pursued by capitalist governments across the Global South. As British Trades Union Congress General Secretary Frances O'Grady said in response to the Ran Plaza disaster, "This appalling loss of life proves that, in the global race to the bottom on working conditions, the finishing line is Bangladesh."5 | |||

The starvation wages, death-trap factories, and fetid slums in Bangladesh are representative of the conditions endured by hundreds of millions of working people throughout the Global South, the source of surplus value sustaining profits and feeding unsustainable overconsumption in imperialist countries. The people of Bangladesh are also in the front line of another calamitous consequence of capitalism's reckless exploitation of living labor and nature: "climate change," more accurately described as ''the capitalist destruction of nature''. Most of Bangladesh is low-lying, and as sea levels rise and monsoons become more energetic, farmland is being increasingly inundated with salt water, accelerating migration into the cities. As a result Bangladesh's capital city, Dhaka, whose population has doubled in the last twenty years and is already one of the largest and most densely populated cities in the world, is growing by more than 600,000 people each year.6 Over-extraction of fresh water is depleting Dhaka's aquifers and, worse still, exposing them to contamination with seawater. To cap it all, Dhaka sits atop an active earthquake zone. Seismologists warn that a Richter 7.5 earthquake would reduce Dhaka to rubble and 80,000 buildings could go the same way as Rana Plaza. The predicted scale of destruction is that high because, surrounded by marshland, much of Dhaka's chaotic, unplanned expansion has been vertical rather than horizontal, typically with the same standard of construction that was exhibited at Rana Plaza.7 None of these negative consequences of capitalist development figure in calculations of Bangladesh's GDP, yet they are real, and are borne by its workers and farmers and by its natural environment. They pay the price, but who profits? How much do the proceeds of their exploitation fuel capitalist development in Bangladesh, and how much of it feeds capitalist accumulation in imperialist countries? | |||

Many commentators have drawn an analogy between the Tazreen and Rana Plaza disasters and notorious disasters in the United States and Europe more than a century ago, arguing that by catalyzing concerted action to tackle underlying causes these recent tragedies could force Bangladesh's garment factory bosses to finally clean up their act. Thus Amy Kazmin, writing in the ''Financial Times'', argued: | |||

Across the globe, industrial disasters have proved effective catalysts for change. New York City's 1911 Triangle Shirtwaist Fire, in which 146 garment workers—mostly women—were killed in part because fire exits were locked, helped spur the growth of the International Ladies' Garment Workers' Union, which successfully fought for better conditions for factory workers, including safety. Many now say that the Rana Plaza disaster—which came five months after a fire at another Bangladeshi factory, Tazreen Fashions, killed 112 people—could start to force similar change.8 | |||

There is no doubt that the Rana Plaza disaster will spur the struggle to unionize Bangladesh's garment industry. But the ''FT'' journalist forgets two things. The response of garment employers to the rise of the ILGWU was to move production to non-union states in the U.S. South, and, eventually, out of the United States altogether, to countries like Bangladesh. Today, just 2 percent of the clothing worn in the United States is actually made there. Peter Custers points out the other weakness in the naïve liberal view expressed by Amy Kazmin: | |||

It is necessary … to be aware of structural differences between nineteenth-century British industries and those in contemporary Bangladesh. For, unlike owners of the former, Bangladeshi garment owners are at the lower end of an international chain of subcontract relations, extending from production units in Bangladesh, via intermediaries, to retail trading companies in the countries of the North…. Garment production has been relocated to, and re-relocated within, the Third World, in order to tap cheap sources of wage labor. While local entrepreneurs obtain a part of the surplus value created, they do not get the major share. Thus, whereas the extraction of surplus value is organized by Bangladeshi owners, its fruits are overwhelmingly reaped by companies in the North.9 | |||

The collapse of Rana Plaza not only shone a light on the pitiless and extreme exploitation of Bangladeshi workers. It also lit up the hidden structure of the global capitalist economy, revealing the extent to which the capital-labor relation has become a relation between Northern capital and Southern labor. The garment industry was the first industrial sector to shift production to low-wage countries, yet power and profits remain firmly in the grip of firms in imperialist countries. This reality is very different from the fantasies projected by neoliberalism's apologists. Few informed observers would dispute that Primark (JCPenney in the United States), Walmart, M&S, and other major UK and U.S. retailers profit from the exploitation of Bangladeshi garment workers. Why else have they raced to outsource the production of their clothes to the lowest of low-wage countries? A moment's thought reveals other beneficiaries: the commercial capitalists who own the buildings leased by these retailers, the myriad companies providing them with advertising, security, and other services; and also governments, which tax their profits and their employees' wages and collect the VAT on every sale. Yet, according to trade and financial data, ''not one penny'' of U.S., European, and Japanese firms' profits or governments' tax revenues derive from the sweated labor of the workers who made their goods. The huge markups on production costs instead appear as "value-added" in the UK and other countries where these goods are consumed, with the perverse result that each item of clothing expands the GDP of the country where it is consumed by far more than that of the country where it is produced.10 Only an economist could think there is nothing wrong about this! | |||

All data and experience, ''except for economic data'', point to a significant contribution to the profits of Primark, Walmart, and other Western firms by the workers who work long, hard, and for low wages to produce their commodities. Yet trade, GDP, and financial flow data show no trace of any such contribution; instead, the bulk of the value realized in the sale of these commodities and all of the profits reaped by the retail giants appear to originate in the country where they are consumed. Exploring and resolving this conundrum is a central task of this book. Our first step is to examine the social, economic, and political relations between workers and employers that are woven into the fabric of each article of apparel produced in low-wage countries like Bangladesh and sold in shopping malls across the imperialist world, where more than 80 percent of garments made in Bangladesh are sold. This will then be augmented by a forensic examination of two other representative "global commodities": the Apple iPhone and the cup of coffee. | |||

=== The T-shirt === | |||

In ''The China Price'', Tony Norfield recounts the story of a T-shirt made in Bangladesh and sold in Germany for €4.95 by the Swedish retailer Hennes & Mauritz (H&M).11 H&M pays the Bangladeshi manufacturer €1.35 for each T-shirt, 28 percent of the final sale price, 40¢ of which covers the cost of 400g of cotton raw material imported from the United States; shipping to Hamburg adds another 6¢ per shirt. Thus €0.95 of the final sale price remains in Bangladesh, to be shared between the factory owner, the workers, the suppliers of inputs and services and the Bangladeshi government, expanding Bangladesh's GDP by this amount. The remaining €3.54 counts toward the GDP of Germany, the country where the T-shirt is consumed, and is broken down as follows: €2.05 provides for the costs and profits of German transporters, wholesalers, retailers, advertisers, etc. (some of which will revert to the state through various taxes); H&M makes 60¢ profit per shirt; the German state captures 79¢ of the sale price through VAT at 19 percent; 16¢ covers sundry "other items." Thus, in Norfield's words, "a large chunk of the revenue from the selling price goes to the state in taxes and to a wide range of workers, executives, landlords, and businesses in Germany. The cheap T-shirts, and a wide range of other imported goods, are both affordable for consumers and an important source of income for the state and for all the people in the richer countries." | |||

The central point Norfield is making cannot be emphasized enough, because so many liberals and socialists in imperialist countries try very hard to put it out of their minds. H&M makes handsome profits, to be sure, but these are dwarfed by the state's take, once taxes on wages and profits of H&M and suppliers of services to it are added to its VAT receipts. In 2013, the tariffs charged by the U.S. government on its apparel imports from Bangladesh alone exceeded the total wages received by the workers who made these goods. The state uses this money, as we know, to finance foreign wars, health care, and Social Security, and even returns a few pennies to the poor countries in the form of "foreign aid." As Tony Norfield argues, low wages in Bangladesh help explain "why the richer countries can have lots of shop assistants, delivery drivers, managers and administrators, accountants, advertising executives, a wide range of welfare payments and much else besides."12 His blunt conclusion: "Wage rates in Bangladesh are particularly low, but even the multiples of these seen in other poor countries point to the same conclusion: oppression of workers in the poorer countries is a direct economic benefit for the mass of people in the richer countries." | |||

In Norfield's account the Bangladeshi factory makes 125,000 shirts per day, of which half are sold to H&M, the rest to other Western retailers. A worker at the factory earns €1.36 per day, for 10–12 hours, producing 250 T-shirts per hour, or 18 T-shirts for each euro cent paid in wages. Her factory is one of 5,000 garment factories in Bangladesh employing 4 million people, 85 percent of whom are women. According to the ILO, the average wage of female "machine operators and assemblers" is 73 percent of their male counterparts.13 Despite the massive influx of women into garment factories, female participation in the labor force in Bangladesh as a whole remains one of the lowest in the world. In 2010, 33.9 percent of working-age women were employed, compared with 79.2 per cent of working-age men. | |||

As noted above, factory wages in Bangladesh are the lowest in the world. An investigation by a UK parliamentary committee into conditions in Bangladesh's garment industry following the Rana Plaza disaster reported that "Bangladesh's comparative advantage, its sole asset value, is cheap labor and its correspondingly low unit costs."14 An in-depth report by leading U.S.-based management consultancy McKinsey & Co. into the growth of Bangladeshi apparel exports included an extensive survey of the outsourcing behavior of U.S. retailers, reporting that Bangladesh "competitive price level is clearly the prime advantage—all CPOs [chief purchasing officers] participating in the study named price attractiveness as the first and foremost reason for purchasing in Bangladesh."15 The price that CPOs find so attractive, of course, is the price of labor-power, but McKinsey & Co., not wishing to offend the sensibilities of their big-business clients, make no mention of low wages anywhere in their study. For months following the Rana Plaza disaster, Bangladesh's Ready-made Garments (RMG) industry was hit by waves of strikes and demonstrations centering on the demand for wage increases (or payment of wages due), the right to form unions, and the enforcement of widely ignored health and safety legislation. The Bangladeshi government, many of whose top officials are factory owners, responded in the same way to previous upsurges in 2006, 2010, and 2012—with violent repression, using the regular police, the ''ansars'' (village-based militias), and the "antiterrorist" Rapid Action Battalion—in addition to the Industrial Police, formed in the midst of the 2010 strike wave, whose sole task is to police garment districts and repress workers' protests. Its 2,900 officers contrast with the grand total of 51 inspectors who, at the time of the Rana Plaza disaster, were charged with enforcing health and safety, minimum age and minimum wage laws in all of Bangladesh's 200,000 workshops and factories, including 5,000 in the garment sector.16 | |||

Nevertheless, with worker militancy growing and with the glare of world attention upon them, in November 2013 the government conceded a 77 percent increase in the minimum wage. This was a significant victory, but far short of the 170 percent wage increase the workers demanded and for which they continue to struggle. It leaves their wages a long way below all estimates of what is needed to feed, clothe, and house their families. According to the Asia Floor Wage Alliance, an alliance of Asian trade unions and activist groups such as the Clean Clothes Campaign, the new basic wage is barely one-fifth of what is necessary to nourish, house, and clothe a garment worker, one adult, and two child dependents.17 The 2013 wage hike was the first increase since 2010, and since then inflation has raised overall prices by 28 percent, and basic necessities like food and cooking oil by much more. | |||

Low wages make big markups possible. In this example, the total markup on the production cost of the "fast fashion" T-shirt is 152 percent. Much higher markups are to be found on more expensive products; one notorious example being the replica football shirt, "a big money-spinner with 80 percent of those sold in the UK made in the Far East for around £5. The factory then sends them on to the sportswear companies at around a 50 percent markup. They in turn mark them up by another 100 percent and sell them to the retailers for around £14. The retailers add their own markup of at least 150 percent to bring the price tag up to the recommended retail price of at least £35. That's 700 percent more than the manufacture cost."18 Another analyst estimates that a Bangladesh-made KP MacLane polo shirt, retailing in the United States for $175, generates a cool 718 percent markup on its cost of production, and a Hermès polo shirt retailing at $455 boasts a markup in excess of 1800 percent.19 These eye-watering markups contrast with the wafer-thin margins left to Bangladeshi suppliers. Writing in the ''Wall Street Journal'', Rubana Huq, owner of a garment factory in Bangladesh, claims to make 12.5¢ on each shirt, whose cost of production is $6.62, a markup of 2 percent.20 This Bangladeshi factory owner is hardly a disinterested party and her claims must be taken with a pinch of salt, but ruthless price-gouging by global buyers is an incontrovertible fact, as a report by British parliamentarians recognized: "In the buyer-driven supply chain margins are thin and the fear of undercutting is strong. As such the purchasing practices of brands can incentivise violations of health and safety through undisclosed subcontracting, excessive working hours, and unauthorized factory expansions."21 | |||

Eloquent testimony to the pressures focused on supplier firms by TNCs was provided by factory owner Ali Ahmad, speaking after 289 garment workers were burned to death in a factory fire in Karachi in September 2012: | |||

You have strikes, load shedding [power outages], local mafias charging you turf protection money—you name it…. Plus you have ruthless buyers sitting in the U.S. who don't care what you do, as long as you do it on time…. We take a hit every time we're late. That means lost margins. That means we do what we need to do to make our orders, fast. This factory owner may have been working extra shifts just for that purpose.22 | |||

According to John Pickles, a leading authority on the global apparel industry, so successful have global buyers been in forcing down wages that they have recently shifted their attention elsewhere: "Marginal gains from squeezing labor costs have been reduced significantly in recent years. When wage levels were driven below subsistence costs, and could not be driven any further down, buyers and suppliers sought out savings in other areas of the value chain (input costs, transaction costs, logistics, coordination costs, demand management, etc.)."23 The result is intensifying pressure on suppliers to slash overheads, ignore health and safety legislation, to impose forced overtime, and to subcontract work to other factories lower down in the pecking order, where working conditions are typically even worse than in the first-tier suppliers, or, as UNCTAD's ''World Investment Report 2013'' put it: "In labor-intensive sectors (such as textiles and garments) where global buyers can exercise bargaining power to reduce costs, this pressure often results in lower wages…. In addition to downward pressure on wages, the drive for reduced costs often results in significant occupational safety and health violations."24 | |||

The "global buyers" can, however, count on some academic witnesses to protect them against charges of culpability. "Factory owners face huge losses if they cannot complete an order and stiff financial penalties if they do not complete it on time," reported a major study by Sarah Labowitz and Dorothée Baumann-Pauly for New York's Stern School of Business.25 Yet this report blames low wages and lethal workplaces on Bangladeshi government corruption, intermittent power supplies, overpopulation—anything but the conscious and deliberate policies of multinational corporations. Abandoning even the pretense of objectivity, Labowitz and Baumann-Pauly state at the outset that their study "is written in the context of … a shared desire for higher standards…. It starts from the premise that the garment sector has greatly benefited the people and the economy of Bangladesh … [and] that business can and does work for the good of society. We support the goal of business to create value while emphasizing high standards for human rights performance."26 This fawning tone contrasts with the harsh rebuke handed down by the authors to "the government of Bangladesh [which] lacks the political will, the technical capacity, and the resources necessary to protect the basic rights of its workers. Bangladesh ranks at or near the bottom across all measures of good governance, including civil justice, regulatory enforcement, and absence of corruption."27 | |||

Also jumping to the defense of big business is Professor Jagdish Bhagwati of Columbia University, considered to be among the foremost theorists of international trade and who confesses to feeling miffed that he is yet to be awarded the Nobel Prize for economics.28 "Since the factories were locally owned and operated, the blame surely belonged to their owners and managers, not to their clients any more than to those of us who purchased the garments at home or abroad."29 For such a brilliant theory, he clearly deserves ''something''! | |||

<small>WELL BEFORE THE RANA PLAZA DISASTER</small>, Bangladesh's dismal record of factory fires and building collapses had provoked intense discussions between NGOs, international union federations IndustriAll and UNI Global Union, and representatives of Western clothing giants. Within two weeks of the building collapse the parties announced the "Accord on Fire and Building Safety in Bangladesh," whose centerpiece is the formation of a new factory inspectorate overseen by a Steering Committee, chaired by the International Labor Organization, made up of three representatives from international unions and three from international companies.30 Several months of lobbying of U.S. and European retail giants resulted in the endorsement of the Accord by over forty leading brands, with GAP and Walmart being notable exceptions. The parties to the Accord agreed to make "all reasonable efforts to ensure that an initial inspection of each factory covered by this Agreement shall be carried out within the first two years", and promised the publication of safety reports, remediation, and safety training. Supplier companies are required to form health and safety committees made up of managers and workers, the latter to be selected by unions or by "democratic election" where no union is present. Touted as "legally binding," the Accord only envisages penalties—that is, loss of orders—against supplier companies. The whole program is to be financed by the Western "brands," through a subscription related to the size of their business in the country. | |||

As we have seen, the fundamental driving force of the race to the bottom and its attendant ills—starvation wages, rickety buildings, atrocious living conditions—is price-gouging by leading firms. How does the Accord address this? Section 22 responds to complaints by factory owners that relentless pressure from international retailers to cut production costs forces them to cut corners: "In order to induce factories to comply with upgrade and remediation requirements of the program, participating brands and retailers will negotiate commercial terms with their suppliers which ensure that it is financially feasible for the factories to maintain safe workplaces and comply with upgrade and remediation requirements instituted by the Safety Inspector." Nobody and no administrative body is tasked with implementing or monitoring this clause. It can only be activated by a factory owner who believes s/he is not receiving "commercial terms" from a global buyer and decides to arraign the global buyer before the Accord's Steering Committee. Should either party disagree with the Steering Committee's ruling, they may submit the dispute to legally binding arbitration. To protect the factory owner from the threat of cancellation of orders, the Accord obliges buying firms to maintain existing contracts for two years. But legal safeguards do not change the extreme power asymmetry—fear of reprisals from their own buyers and blacklisting by others mean factory owners will hesitate to take this path. And the Accord's mechanisms involve international union representatives in giving their assent to "commercial terms" that do not provide for garment workers to be paid a living wage. | |||

<small>SUSCEPTIBILITY TO FIRE AND COLLAPSE</small> are far from the only building safety issues in Bangladesh. Most deaths and injuries in the year following the Rana Plaza disaster resulted from stampedes sparked by the outbreak of small fires, revealing the lack of exits and stairwells.31 Despite Bangladesh's sweltering climate, where temperatures often reach into the mid-90s and humidity is high year-round, lack of ventilation, often compounded by chemical vapors from dyes and other inputs, are among the unhealthy and unsafe working conditions not covered by the "Accord on Fire and Building Safety." Nor is there any mention in the Accord of excessive and forced overtime, a key health and safety issue; nor are supplier factories required to allow trade unions to organize—despite shop-floor union organization being the most important line of defense against dangerous working practices. Nevertheless, Jyrki Raina described the Accord as "historic"; Philip Jennings, General Secretary of UNI, defined it as a "turning point" that marked "the end of the race to the bottom in the global supply chain"; and a joint press release from IndustriALL and UNI generously described their multinational partners as "the most progressive global fashion brands."32 | |||

After Rana Plaza, Jyrki Raina pledged to "use the global muscle of IndustriALL to create sustainable conditions for garment workers, with the right to join a union, with living wages, and safe and healthy working conditions." Yet unions in Western Europe and North America outsourced the organization of protests to anti-sweatshop activists and campaigning charities and did nothing to mobilize their members in solidarity. Unions in North America added their names to an "international day of action to end deathtraps" in June 2013, but there is no evidence of any serious effort to build this action. Instead, their reflex has been to act in partnership with imperialist governments and international brands. The UK trade union Unite and North America's United Steelworkers, both of which are affiliated to IndustriALL, issued a joint statement a few days after the Rana Plaza disaster urging the U.S. and European governments "to immediately suspend Bangladesh's market access under the Generalized System of Preferences" and "to enact laws … that would ban the importation of goods produced under sweatshop conditions."33 The Generalized System of Preferences (GSP) allows tariff-free imports into North America and Europe from the "Least Developed Countries." In the United States, union officials successfully petitioned the U.S. government to rescind Bangladesh's tariff-free access to the U.S. market, inducing President Barack Obama to piously declare to the U.S. Congress on June 27, 2013, that Bangladesh "is now taking steps to afford internationally recognized worker rights." Richard Trumka, president of the AFL-CIO, welcomed the decision, declaring, "The decision to suspend trade benefits sends an important message to our trading partners…. Countries that tolerate dangerous—and even deadly—working conditions and deny basic workers' rights, especially the right to freedom of association, will risk losing preferential access to the U.S. market."34 | |||

This move was largely symbolic—because of protectionist pressure from U.S. employers and union officials, less than 1 percent of imports from Bangladesh enter the United States free of tariffs. Until Obama rescinded even this, the biggest beneficiary was tobacco, followed by plastic bags, golf equipment, and hotel crockery. In 2013, the U.S. government received $809.5 million in customs duties on $4.9 billion of garment exports from Bangladesh, an average tariff of 16.5 percent.35 The average wage of the 4 million workers in Bangladesh's RMG industry in the year of the Rana Plaza disaster, before the November 2013 increase, was $780 per year, for a total wage bill of $3.1bn.36 The United States imports 22 percent of Bangladesh's apparel exports, so it can be estimated that 22 percent of $3.1bn, or $690m, was paid in wages to the workers who produced goods destined for the United States. In other words, the tariffs charged in 2013 by the U.S. government on its apparel imports from Bangladesh alone exceeded the total wages received by the workers who made these goods. And this punitive protectionist policy is carried out at the behest of union officials who claim to be concerned about the plight of Bangladeshi workers! | |||

The protectionist policies supported by union officials in imperialist countries are roundly opposed by Bangladeshi trade unions and labor activists and for this reason are not promoted by IndustriALL or UNI, which include Bangladeshi trade union affiliates. Dr. Supachai Panitchpakdi, Secretary-General of UNCTAD (United Nations Conference on Trade and Development), denounced calls for punitive tariffs as a "a serious threat to the rule-based global trading system," adding that, instead of penalizing Bangladeshi employers and workers in the name of "labor rights," importing countries "must look at the business practices of their retail and wholesale industry because the problem with global value chains is the way they are exploiting the sweatshops in poor countries which are providing cheap labor."37 | |||

These issues are not new. Union officials and social-democratic politicians in imperialist countries have long sought to protect their workers from "unfair competition" from workers in poor countries, hiding behind feigned concern for human rights in oppressed nations. Their hypocrisy was exposed by Palash Baral, a representative of UBINIG (Policy Research for Development Alternatives), a Bangladeshi NGO, in remarks to a seminar in London organized by the UK campaigning charity War on Want in the mid-1990s:<blockquote>The issues of "labor standards" and "workers rights" have been raised out of no concern for our workers, neither do they constitute any concern for human rights. They are neo-protectionist slogans and reflect attempts by the ruling class of the North to smokescreen the real cause of the economic crisis the North is going through…. The World Bank and IMF create the conditions for "social dumping" … [then] some NGOs as well as some trade unions propose to "civilise" us … by twisting our arms when we come to sell our products to their markets. They have nothing to say against the World Bank, no complaints about Structural Adjustment and no attempt to understand the transnationals and their behaviour … if one is really serious about labor standards and workers' rights, then one should join hands with the workers of Bangladesh.38</blockquote> | |||

=== The iPhone === | |||

In contrast to the humble T-shirt, iPhones and laptops are technologically complex commodities. Their dazzling sophistication and iconic brand status can too easily blind the observer to the exploitative and imperialist character of the social and economic relations they embody. Nevertheless, the same fundamental relationships that can be seen in the simple article of apparel are also visible in the latest high-tech gadgetry. The same question that we have asked of the T-shirt hanging from your shoulders could also be asked of the smartphone in your trouser pocket, or indeed of any other global commodity; that is, any other product of globalized production processes. The question we have asked of the T-shirt can also be asked of the iPhone: what contribution do the 1.23 million workers employed by Foxconn International in Shenzhen, China, who assemble Dell's laptops and Apple's iPhones—and the tens of millions of other workers in low-wage countries around the world who produce cheap intermediate inputs and consumer goods for Western markets—make to the profits of Dell, Apple, and other leading Western firms? Or to the income and profits of the service companies that provide their premises, retail their goods, etc.? According to GDP, trade, and financial flow statistics, and to mainstream economic theory, ''none whatsoever''. Apple does not own the Chinese, Malaysian, and other production facilities that manufacture and assemble its products. In contrast to the in-house, foreign direct investment relationship that used to typify transnational corporations, no annual flow of repatriated profits is generated by Apple's "arm's length" suppliers. Just as with the T-shirt, the standard interpretation of data on production and trade assumes that the slice of the iPhone's final selling price captured by each U.S., Chinese, and other national firm is identical to the "value-added" that each contributed. They reveal no sign of any cross-border profit flows or value transfers affecting the distribution of profits to Apple and its various suppliers. The only part of Apple's profits that appear to originate in China are those resulting from the sale of its products in that country. As in the case of the T-shirt made in Bangladesh, so with the latest electronic gadget: the flow of wealth from Chinese and other low-wage workers sustaining the profits and prosperity of Northern firms and nations is rendered invisible in economic data and in the brains of the economists. | |||

<small>APPLE'S PRODUCTS, AND THOSE OF DELL</small>, Motorola, and other U.S., European, South Korean, and Japanese companies—an estimated 40 percent of the world's consumer electronics, according to the ''New York Times''—are assembled by FoxConn, the major subsidiary of Taiwan-based Hon Hai Precision Industries.39 Its complex of fourteen factories at Shenzhen in southern China became famous both for its sheer size and for the fourteen suicides among its workers in 2010—and for the management's ham-fisted attempts to show its concern, by erecting nets to catch workers jumping from dormitory windows. FoxConn's Shenzhen workforce peaked that year at around 430,000 workers and was then scaled back in favor of plants elsewhere in China. Most of these are young migrant workers whose right to reside in the city is dependent on their employment, who have no access to municipally provided health and education services, and who cannot bring their families to live with them. In 2013, according to Chinese government figures, 260 million workers were officially defined as residents of their rural places of origin, denying them legal rights and access to a wide range of benefits in the cities where they now live and work.40 This is the ''hukou'' system, through which the CCP government has sought to control the influx of labor from the countryside and to create a cheap captive labor force for TNCs and their suppliers. ''Hukou'' is a source of deep social divisions and tensions, as the regime promises its reform but resists growing demands for its abolition. | |||

Citing a 2012 survey of "ten factories producing Apple products in China, including a Foxconn plant," Marty Hart-Landsberg reports: | |||

Low wages compel workers to accept long overtime hours. Most of the factories pay a basic salary equal to the minimum wage stipulated by the local law (around $200/month), so low that workers have to work long hours to support themselves…. The average overtime in most of the factories was between 100 and 130 hours per month, and between 150 and 180 hours per month during peak production season, well above China's legal limits. In most factories, workers generally work 11 hours every day, including weekends and holidays during peak seasons. Normally they can only take a day off every month, or in the peak seasons may go several months without a day off.41 | |||

In one of the studies cited by Hart-Lansberg, Pun Ngai and Jenny Chan gathered testimonies from workers at Foxconn's Shenzhen factories that provide many insights into the brutal labor regime that is part of the hidden price for Apple's super profits and Western consumers' access to the latest high-tech gadgets: | |||

No admittance except on business—every Foxconn factory building and dormitory has security checkpoints with guards standing by 24 hours a day. In order to enter the shop floor, workers must pass through layers of electronic gates and inspection systems. Our interviewees repeatedly expressed the feeling that the entry access system made them feel as if working at Foxconn is to totally lose one's freedom…. While getting ready to start work on the production line, management will ask the workers: "How are you?" Workers must respond by shouting in unison, "Good! Very good! Very, very good!" This militaristic drilling is said to train workers as disciplined laborers…. Workers recalled how they were punished when they talked on the line, failed to keep up with the high speed of work, and made mistakes in work procedures.42 | |||

Not only does the length of the workday and the workweek test the limits of human endurance, workers are forced to work with great intensity throughout their long hours: | |||

"We can't stop work for a minute. We're even faster than machines." A young woman worker added, "Wearing gloves would eat into efficiency, we have a huge workload every day and wearing gloves would influence efficiency…." On an assembly line in the Shenzhen Longhua plant, a worker described her work to precise seconds: "I take a motherboard from the line, scan the logo, put it in an antistatic-electricity bag, stick on a label, and place it on the line. Each of these tasks takes two seconds. Every ten seconds I finish five tasks." | |||

<small>THESE TESTIMONIES REMIND US THAT</small> ultra-low wages are not the only factor attracting profit-hungry Western firms to newly industrializing countries. As in the case of Bangladesh's garment industry, they are also attracted by the flexibility of the workers, the absence of independent unions, the relative ease with which they can be forced to submit to working days as long as those described by Marx and Engels in mid-nineteenth-century England, and the intensity with which they can work. Charles Duhigg and Keith Bradsher, in a widely quoted ''New York Times'' study, provide a vivid illustration of this: | |||

One former executive described how [Apple] relied upon a Chinese factory to revamp iPhone manufacturing just weeks before the device was due on shelves. Apple had redesigned the iPhone's screen at the last minute, forcing an assembly line overhaul. New screens began arriving at the plant near midnight. A foreman immediately roused 8,000 workers inside the company's dormitories, according to the executive. Each employee was given a biscuit and a cup of tea, guided to a workstation and within half an hour started a 12-hour shift fitting glass screens into beveled frames. Within 96 hours, the plant was producing over 10,000 iPhones a day.43 | |||

Terry Gou, chairman of Hon Hai, FoxConn's parent company, provoked a storm of criticism in January 2012 with his remark, during a visit to Taipei zoo, that "as human beings are also animals, to manage one million animals gives me a headache," following this up with a request to the zookeeper for advice on how best to manage his "animals." ''Want China Times'' commented, "Gou's words could have been chosen more carefully…. At its huge plants in China … working and living conditions are such that many of its Chinese employees might well agree that they are treated like animals."44 | |||

<small>IT IS WORTH PAUSING AT THIS POINT</small> to see how the ideologues of neoliberalism justify the brutal labor regimes fostered by the policies they have designed and promoted. Jagdish Bhagwati argues that TNCs provide job opportunities to eager workers at higher rates of pay than alternative jobs and therefore cannot be said to be exploiting anyone: "If the wages received are actually higher than those available in alternative jobs, even if low according to the critics … surely it seems odd to say that the multinationals are exploiting the workers they are hiring!"45 Such charges seem absurd to him because, whatever the level of wages that prevail within a country, if they are market-determined then that is what these workers are worth, and TNCs paying slightly more cannot be accused of exploitation. Whether or not these wages meet the worker's minimum biological needs, and how hard or long s/he has to work to earn that wage, is irrelevant. Moreover, "By adding to the demand for labor in the host countries, multinationals are also overwhelmingly likely to improve wages all round, thus improving the incomes of workers in these countries."46 Yet, as we shall explore in chapters 4 and 5, nowhere, not even in China, have jobs generated by export-oriented industrialization kept pace with the growth of the labor force, greatly limiting these alleged beneficial effects. | |||

In a similarly cavalier manner, Bhagwati dismisses charges that there is any problem with hazardous working conditions and violations of labor law in poor countries—or, if there is, none that multinational companies should take responsibility for: | |||

It is highly unlikely that multinational firms would violate domestic regulatory laws, which generally are not particularly demanding. Since the laws are often not burdensome in poor countries, it is hard to find evidence that violations are taking place in an egregious, even substantial fashion…. Sweatshops are typically small-scale workshops, not multinationals. If the subcontractors who supply parts to the multinationals, for example, are tiny enterprises, it is possible that they, like local entrepreneurs, violate legislation from time to time. But since the problem lies with the lack of effective enforcement in the host country, do we hold multinationals accountable for anything that they buy from these countries, even if it is not produced directly by the multinationals?47 | |||

The reality Bhagwati so blithely dismisses is succinctly summarized by UNCTAD: | |||

Buyer-driven GVCs [Global Value Chains] are typically focused on reduced sourcing costs, and … this means significant downward pressure on labor costs and environmental management costs. Some suppliers are achieving reduced labor costs through violations of national and international labor standards and human rights laws. Practices such as forced labor, child labor, failure to pay minimum wage and illegal overtime work are typical challenges in a number of industries. In addition to downward pressure on wages, the drive for reduced costs often results in significant occupational safety and health violations…. Downward pricing pressure has created economic incentives for violating environmental regulations and industry best practices, leading to the increased release of disease-causing pollutants and climate change–related emissions. Cutting costs by engaging in negative social and environmental practices is a particularly acute trend in developing countries.48 | |||

Bhagwati even uses a feminist argument to defend his beloved multinational corporations, and was one of the few to spring to the industries' defense after the Rana Plaza disaster. Casting around for evidence of the "liberating effect [on] young girls in Bangladesh" of employment in garment factories, he quotes a study on girls' adolescence in developing countries: | |||

Unmarried girls employed in these garment factories may endure onerous working conditions, but they also experience pride in their earnings, maintain a higher standard of dress than their unemployed counterparts and, most significantly, develop an identity apart from being a child or wife…. Legitimate income-generating work could transform the nature of girls' adolescent experience. It could provide them with a degree of autonomy, self-respect, and freedom from traditional gender work.49 | |||

This is, to say the least, shallow and one-sided. It casually dismisses the conclusions of decades of feminist-inspired research into "the ways in which apparently modern factory organization drew on, and indeed actively promoted, cultural norms of femininity which helped to legitimate employers' 'super-exploitation' of their predominantly female workforce."50 It forgets that TNCs and their suppliers hire "young unmarried girls" in order to profit from their oppression, not to liberate them from it; and it follows from Bhagwati's own theories of self-interested, profit-maximizing behavior that employers and politicians, who in Bangladesh are often the same people, have every interest in maintaining the double oppression of women—from which they benefit directly, through even lower wages, and indirectly, by entrenching gender divisions among workers. To this end they counter the potentially liberating effect of female factory employment by using every weapon at hand to perpetuate female submissiveness—including endemic violence, humiliation, and sexual abuse of women workers by male overseers, non-enforcement of laws on maternity leave and childcare, and the use of definitions of "skill" to downgrade women's labor.51 This is not to mention the broader ideological offensive, in which promotion of obscurantist religious ideology, which in Bangladesh takes the form of Islamic fundamentalism, is aimed at preventing women workers from seeing themselves, and from being seen by others, as workers rather than housewives, as full and equal members of society rather than as possessions and appendages of present or future husbands. | |||

The enormous influx of women into factory labor, even in countries like Bangladesh where they have traditionally been confined within the home, will be analyzed in more detail in a later chapter; so too the relation between capitalist exploitation of waged labor and women's oppression and their performance of unpaid domestic labor. | |||

<small>THE APPLE IPHONE AND RELATED PRODUCTS</small> are prototypical global commodities, the result of the choreography of an immense diversity of concrete labors of workers in five continents. Contained within each hand-held device are the social relations of contemporary global capitalism. | |||

Research on the Apple iPod published in 2007 by Greg Linden, Jason Dedrick, and Kenneth Kraemer is particularly valuable because it does something not attempted in the more recent studies cited here. These researchers attempt to quantify the living labor directly involved in the design, production, transportation, and sale of this Apple product, and also report the vastly different wages received by these diverse groups of workers.52 | |||

In 2006, the 30GB Apple iPod retailed at $299, while the total cost of production, performed entirely overseas, was $144.40, giving a gross profit margin of 52 percent. What Linden et al. call gross profits, the other $154.60, is divided among Apple, its retailers and distributors, and—through taxes on sales, profits, and wages—the U.S. government. All of this, 52 percent of the final sale price, is counted as value-added generated within the United States and contributes toward U.S. GDP. Linden et al. found that "the iPod and its components accounted for about 41,000 jobs worldwide in 2006, of which about 27,000 were outside the U.S. and 14,000 in the U.S. The offshore jobs are mostly in low-wage manufacturing, while the jobs in the U.S. are more evenly divided between high-wage engineers and managers and lower-wage retail and non-professional workers."53 | |||

Just thirty of the 13,920 U.S. workers were production workers (receiving, on average, $47,640 per year), 7,789 were "retail and other non-professional" workers (average wages, $25,580 per year), and 6,101 were "professional" workers, that is, managers and engineers involved in research and development. The latter category captured more than two-thirds of the total U.S. wage bill, receiving, on average, $85,000 per annum. Meanwhile, 12,250 Chinese production workers received $1,540 per annum, or $30 per week—just 6 percent of the average wages of U.S. workers in retail, 3.2 percent of the wages of U.S. production workers, and 1.8 percent of the salaries of U.S. professional workers.54 The number of workers employed in iPod-related activities was similar in the United States and China, yet the total U.S. wage bill was $719m and the total Chinese wage bill was $19m. | |||

A study published by the Asian Development Bank (ADB) in 2010 reported on the first version of Apple's next big product, revealing an even more spectacular markup: "iPhones were introduced to the U.S. market in 2007 to large fanfare, selling an estimated 3 million units in the U.S. in 2007, 5.3 million in 2008, and 11.3 million in 2009." The total manufacturing cost of each iPhone was $178.96 and sold for $500, yielding a gross profit of 64 percent to be shared between Apple, its North American suppliers and distributors, and the U.S. government, all appearing as value-added generated within the United States. The main focus of the ADB study was the effect of iPhone production on the U.S.-China trade deficit, finding that "most of the export value and the deficit due to the iPhone are attributed to imported parts and components from third countries…. Chinese workers … contribute only US$6.50 to each iPhone, about 3.6 percent of the total manufacturing cost."55 Thus, more than 96 percent of the export value of the iPhone is composed of re-exported components manufactured elsewhere, all of which counts toward China's exports but none counts toward China's GDP.56 The authors do not investigate in detail how these gross profits are shared between Apple, suppliers of services, and the U.S. government, but they can hardly avoid commenting on their spectacular size: "If the market were fiercely competitive, the expected profit margin would be much lower…. Surging sales and the high profit margin suggest that … Apple maintains a relative monopoly position…. It is the profit maximization behavior of Apple rather than competition that pushes Apple to have all iPhones assembled in the PRC."57 | |||

This leads the ADB researchers to imagine a scenario in which Apple moved iPhone assembly to the United States. They assume U.S. wages to be ten times higher than in China and that these hypothetical U.S. assembly workers would work as intensely as the real ones do at FoxConn, calculating that "if iPhones were assembled in the U.S. the total assembly cost would rise to US$65 and would still leave a 50 percent profit margin for Apple."58 They finish with an appeal to Apple to show some "corporate social responsibility" by "[g]iving up a small portion of profits and sharing them with low skilled U.S. workers" and re-shore iPhone assembly to the United States.59 The researchers do not consider Apple's "corporate social responsibility" to the Chinese workers who are paid a pittance for their labor and who would be made redundant if Apple were to follow the ADB's advice. And it should be noted that whether the profit margin is 64 percent or 50 percent, it is not just "Apple's profit"—Apple must share this markup with its service suppliers and the U.S. government. | |||

The first version of the iPhone was also the first-ever smartphone, so Apple's initial markup might be thought of, in part at least, as a reflection of its unique status.60 Since then Samsung, HTC, Nokia, and other producers have launched their own smartphones—indeed, in the first quarter of 2014 Apple's share of the global smartphone market had fallen to just 15 percent by units sold, half Samsung's share. "Apple remains strong in the premium smartphone segment, but a lack of presence in the entry-level category continues to cost it lost volumes in fast-growing emerging markets such as Latin America," said one industry analyst.61 Yet, seven years after the launch of the first iPhone, Apple has broadly succeeded in maintaining these exorbitant markups. According to a report by UBS researchers published in September 2013, the production cost of a 16GB iPhone 5C was $156, rising to $213 for a 16GB iPhone5S, while the retail price for each unlocked handset is $549 and $649 respectively, yielding gross profit margins of 61 percent and 67 percent.62 Nevertheless, according to the ''Financial Times'' Lex column, "Phones, even Apple's, are becoming commoditised. Apple is selling more phones, but making less money: each iPhone went for an average $41 less than in the previous quarter as cheaper older models spearheaded an emerging markets push."63 | |||

<small>IT IS PARTICULARLY INSTRUCTIVE TO COMPARE</small> Apple's profits and share price with those of its principal supplier. In the year to May 2013 Hon Hai made $10.7bn in profits (on sales of $132.1bn), which works out as $8,685 for each of its 1,232,000 employees, compared to Apple's $41.7bn profits (on sales of $164.7bn), or $572,800 profit for each of its 72,800 employees (47,000 of whom are in the United States). In May 2013, Hon Hai's share price valued the company at $32.1bn; while Apple, with not a factory to its name, was valued at $416.6bn.64 Since overtaking Exxon in 2011, Apple has reigned supreme as the world's most valuable company. During that year Apple's earning growth was large enough to cancel out the decline in the earnings of all other U.S. companies, thereby providing crucial support to the U.S. economy as it struggled to emerge from the post-Lehman crash.65 Further boosting its share price, it has accumulated a huge cash stockpile—standing at $146.8bn at the beginning of 2014, despite returning billions of dollars to shareholders in a share buy-back scheme—that it has no productive use for.66 | |||

Meanwhile, in what one study called a "paradox of assembler misery and brand wealth," Hon Hai's profits and share price have been caught in the pincers of rising Chinese wages, conceded in the face of mounting worker militancy, and by increasingly onerous contractual requirements, as the growing sophistication of Apple's and other firms' products increase the time required for assembly.67 While Apple's share price has risen more than tenfold since 2005, over the same period Hon Hai's share price slumped by more than 80 percent. The ''Financial Times'' reported in August 2011 that "costs per employee [are] up by exactly one-third, year-on-year, to just under U.S.$2,900. The total staff bill was $272m: almost double gross profit…. Rising wages on the mainland helped to drive the consolidated operating margin of the world's largest contract manufacturer of electronic devices … from 4–5 percent 10 years ago to a 1–2 percent range now."68 | |||

The company is seeking cheaper labor and reduced dependence on the increasingly restive Shenzhen workforce, and as ''FT'' columnist Robin Kwong reports, "Hon Hai … has invested heavily in shifting production from China's coastal areas to further inland and is in the process of increasing automation at its factories. As a result, Hon Hai last year saw its already-thin margins shrink even further."69 FoxConn, which in 2013 reportedly relied on iPods and iPhones for at least 40 percent of its revenue, has moved its iPhone 5 assembly to Zhengzhou in northern China, where 100 assembly lines, each with three shifts of 600 workers working around the clock and exclusively occupied in iPhone assembly, churn out 500,000 handsets every day.70 Along with thousands more employed in the production of metal casings and ancillary staff, a total of 300,000 workers are dedicated to meeting Apple's iPhone orders. Apple's dependence on Hon Hai is a vulnerability as well as a source of revenues and profits; industry analysts report in April 2014 that Apple is set to dilute its dependence on FoxConn and outsource part of the production of the iPhone 6 to another Taiwan-based electronics contract manufacturer, Pegatron, which to this end is building a giant factory near Shanghai. | |||

The combination of sharply rising wages, heavy capital spending, and relentless cost-cutting by Apple is bad enough, but worst of all is the chronic sickness into which Hon Hai's and China's principal export markets have fallen. Kwong concludes, "it is not hard to see why the last thing Gou needs now, after building all those inland factories, is a slowdown in demand."71 | |||

=== The cup of coffee === | |||

Our picture is completed by the addition of a third iconic global commodity—the cup of coffee. Perhaps you have one clasped in your hand—don't spill any on your T-shirt or your smartphone as you read this! Coffee is unique among major internationally traded agricultural commodities in that none of it, apart from small quantities grown in Hawaii, is grown in imperialist countries, and for this reason it has not been subject to trade-distorting agricultural subsidies such as those affecting cotton and sugar. Yet the world's coffee farmers have fared as badly if not worse than other primary commodity producers. Most of the world's coffee is grown on small family farms, providing employment worldwide to 25 million coffee farmers and their families, while two U.S. and two European firms, Sara Lee and Kraft, Nestlé and Procter & Gamble, dominate the global coffee trade. | |||

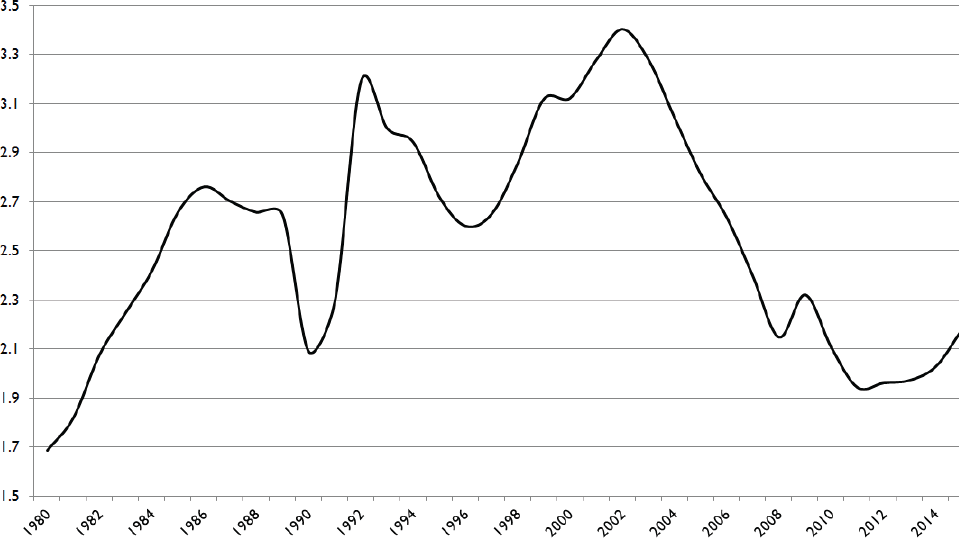

In common with other global commodities, the portion of the final price of a bag or a cup of coffee that is counted as value-added within the coffee-drinking countries has steadily risen over time. According to the International Coffee Organization, the markup on the world market price of coffee for nine imperialist nations that account for more than two-thirds of global imports averaged 235 percent between 1975 and 1989, 382 percent between 1990 and 1999, and 429 percent between 2000 and 2009.72 As this report points out, these impressive figures significantly underestimate both the magnitude of the markup and also the pace of its increase, since it is based on the assumption that all imported coffee is sold to consumers at market prices, whereas an increasing percentage of coffee consumption takes place in local cafés, where the markup is considerably higher. How much higher can be estimated by considering that a barista typically obtains 60 shots of espresso per pound bag of coffee, that is, approximately 15¢ per shot. Adding another 15¢ for milk, sugar, and a disposable cup, the $3 retail price represents a 900 percent markup over the cost of its ingredients.73 | |||

It is notable that the trend toward ever-higher markups has continued whether the world market price of coffee is rising or falling. The period between 1975 and 1989 was marked by increasing overproduction and falling world prices, despite the operation of the International Coffee Agreement, established in 1962, which attempted to protect both producers and consumers from wild fluctuations in coffee prices through a complex system of quotas and the use of buffer stocks. Driven by ideological opposition to interference in free markets, the coffee-swilling nations torpedoed the agreement in 1989. The 1990 to 1999 period duly saw wild fluctuations in the world market price of coffee, which finished the decade even lower than it started, reaching rock bottom in 2002, 83 percent below its 1980 level. In 2002, coffee exporters earned a total of $5.5bn, to be shared among export companies, governments, and an estimated 125 million coffee farmers and their families. Ignoring the slice taken by exporters and governments, this works out to $44 per person per year, way below the $1.25/day that the World Bank defines as "extreme poverty." Oxfam reported that "there has never been such a dramatic collapse in the coffee market," and urged immediate action to mitigate the devastating effects on coffee producers and coffee-producing nations, pleas that were completely ignored.74 During the first decade of the new millennium coffee prices recovered from their historic lows, tripling in value by the decade's end, yet the markup in the imperialist nations and therefore the contribution of coffee to their GDPs continued to rise. By 2010 coffee had been swept up in the "commodities supercycle," fueled by increasing demand in China and other new consumers and also by speculative financial flows driven by ultra-low interest rates in the main imperialist economies. Having tripled between 2002 and 2010, in a matter of months the market price of coffee doubled again, reaching a thirty-four-year high in March 2011, only to fall 60 percent by November 2013 as speculators took their profits. An unprecedented drought in Brazil, the world's biggest producer, provoked an 85 percent rise in the world market price in the first four months of 2014, amid accumulating evidence that capitalism-induced climate change is already wreaking havoc on tropical agriculture and ecosystems. These wild gyrations have terrible consequences for coffee producers, but they create immense opportunities for speculation and profiteering for imperialist coffee monopolies and financial speculators. | |||

The real human cost of the imperialist-dominated global coffee market cannot be grasped by mere statistics, however. The destruction of the International Coffee Agreement in 1989 played a crucial but almost completely unacknowledged role in the creation of the conditions for genocide in Rwanda. This poor African nation relied almost exclusively on coffee for its export earnings. As the world market price of coffee plummeted so did the Rwandan economy, bringing famine, hyperinflation, and government collapse down on the heads of the Rwandan people. When the Rwandan government begged the IMF for emergency assistance, the latter duly responded with a stingy loan and a savage structural adjustment program that only intensified the misery and insecurity of the Rwandan people.75 Isaac Kamola, in the aptly named ''The Global Coffee Economy and the Production of Genocide in Rwanda'', adds that "these economic stresses created the conditions in which state-owned enterprises went bankrupt, health and education services collapsed, child malnutrition surged and malaria cases increased by 21 percent."76 Michel Chossudovsky, in ''The Globalization of Poverty'', comments that "no sensitivity or concern was expressed [by the IMF] as to the likely political and social repercussions of economic shock therapy applied to a country on the brink of civil war…. The deliberate manipulation of market forces destroyed economic activity and people's livelihood, fuelled unemployment and created a situation of generalized famine and social despair."77 Apart from these and a few other exceptions, it is shocking the degree to which the causal role played by the destruction of the International Coffee Agreement and the IMF's imposition of brutal austerity in Rwanda's genocide has been ignored, both in the copious Western media coverage of the terrible events of 1994 and in the academic literature generated by it. | |||

Coffee differs from the T-shirt and the iPhone in one important respect: unlike the other members of this profane trinity, coffee does not arrive in the consuming nations as a finished good, already bagged and labeled and ready for sale. Part of the gross value-added captured by coffee retailers within the imperialist countries production therefore corresponds to the roasting and grinding of the dry cherries, and also, in the case of coffee consumed in cafés, the production labor of the barista. Yet this does not change the overall picture. Roasting and grinding coffee beans, in contrast to their cultivation, is not labor-intensive, one reason why the imperialist monopolies that dominate the global coffee economy have not been tempted to outsource this production task. Another reason is to ensure that monopoly power remains concentrated in their hands: the big markups and juiciest profits are in the processing of the raw beans, unlike in the clothing industry, where the big markups are obtained from the retailing of finished garments, or smartphones, where Apple's fat profits arise from patented technology as well as branding and retailing. Those who cultivate and harvest the coffee receive less than 3 percent of its final retail price.78 In 2009, according to the International Coffee Organization, the roasting, marketing, and sale of coffee added $31bn to the GDP of the nine most important coffee-importing nations, more than twice as much as all coffee-producing nations earned from growing and exporting it—and, as noted above, this does not include the value-added captured by cafés and restaurants. | |||

Just as, according to the economists and accountants, not one cent of Apple's profits comes from Chinese workers and just as H&M's bottom line owes nothing to super-exploited Bangladeshi workers, so do all of Starbucks' and London-based Caffè Nero's profits appear to arise from their own marketing, branding, and retailing genius, and not a penny can be traced to the impoverished coffee farmers who hand-pick the fresh cherries. In all of our three archetypical global commodities, gross profits, that is, the difference between their cost of production and their retail price, are far in excess of 50 percent, flattering not only Northern firms' profits but also their nations' GDP.79 | |||

Squeezing wages allows markups to increase. Thus UNCTAD reports that "clothing, footwear, textiles, furniture, miscellaneous manufacturers (which includes toys) and chemicals all experienced import price declines (relative to U.S. consumer prices) over two decades of more than 1 percent per year on average, or 40 percent over the period 1986–2006."80 | |||

<small>THIS CHAPTER'S INVESTIGATION INTO THE SOCIAL</small> relations embodied in three global commodities yields some important paradoxes and anomalies requiring further analysis and a series of distinct dimensions that need to be investigated separately before they can be brought together in a synthesis, a theory of the latest stage of capitalism's imperialist evolution. Together they shape the book's overall structure, and can be resolved into seven themes that will be addressed in the following sequence: | |||

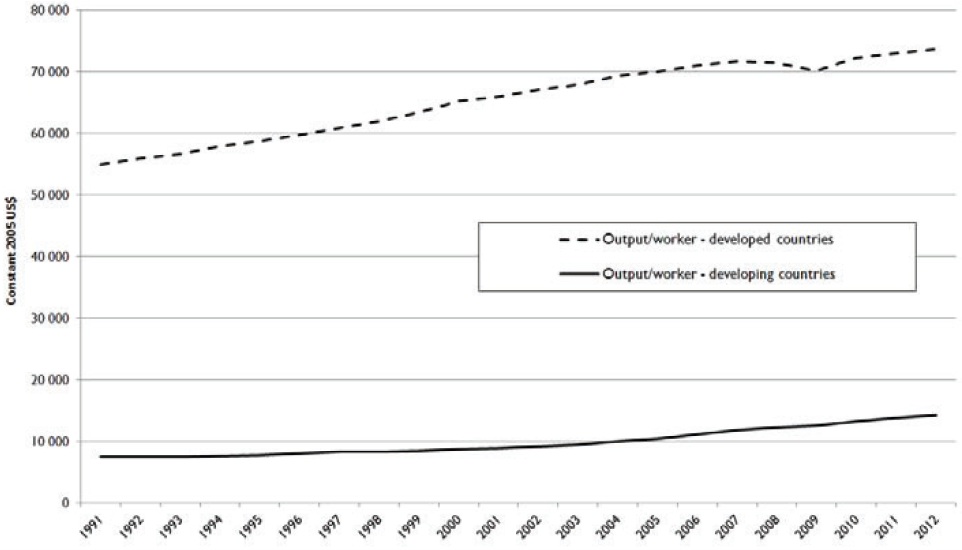

<small>1. THE GLOBAL SHIFT OF PRODUCTION TO LOW-WAGE COUNTRIES</small>. The T-shirt, the iPhone, and the cup of coffee are representative examples of the universe of global commodities, i.e., the products of global value chains and globalized production networks. Chapters 2 and 3 turn the telescope around, so to speak, and survey the transformation and global shift of production that these archetypical commodities are representative of. Chapter 2, "Outsourcing, or the Globalization of Production," analyzes neoliberal globalization's most important transformation: the globalization of production processes, discovering its antecedents, its proportions, its qualities, its dynamism, and its driving force: the hunger of Northern capitalists for low-wage labor corralled in Southern nations. Chapter 3, "The Two Forms of the Outsourcing Relationship," continues the study of global outsourcing by analyzing three aspects of particular importance: the differences and similarities between the two forms of the outsourcing relationship—"in-house" and the increasingly favored "arm's length" relations with an independent supplier; the peculiar structure of world trade, in which firms in low-wage nations compete with each other in export markets, as do firms in imperialist nations, but competition between firms in imperialist and low-wage nations is by and large absent, their relationship is complementary, not competitive; and the divergence between the low-wage nations' increasing share of manufacturing trade and the much less impressive growth in their share of global manufacturing value-added. | |||

<small>2. CONDITIONS IN LABOR MARKETS ARE AT LEAST AS IMPORTANT AS CONDITIONS IN PRODUCT AND CAPITAL MARKETS</small>. This first chapter has highlighted the critical importance of conditions in labor markets, as well as product and financial markets, to any understanding of the forces shaping the global political economy. Chapter 4, "Southern Labor: Peripheral No Longer," examines the economic and social conditions that determine the terms on which Southern workers can sell their labor-power, paying particular attention to the massive structural unemployment and underemployment in low-wage nations and to the violent suppression of the free movement of working people across the borders between imperialist and low-wage countries, arguing that this lies at the root of the vast wage differentials. The role of these characteristic features of so-called development in the promotion of informal, flexible, and precarious labor regimes is analyzed, and the chapter concludes by studying the intersection of patriarchy, class, and imperialism that gives rise to another striking feature of the global transformation of production, one that is highlighted in particular by Bangladesh's ready-made garment industry: the massive influx of women into wage labor in general and manufacturing production in particular. | |||

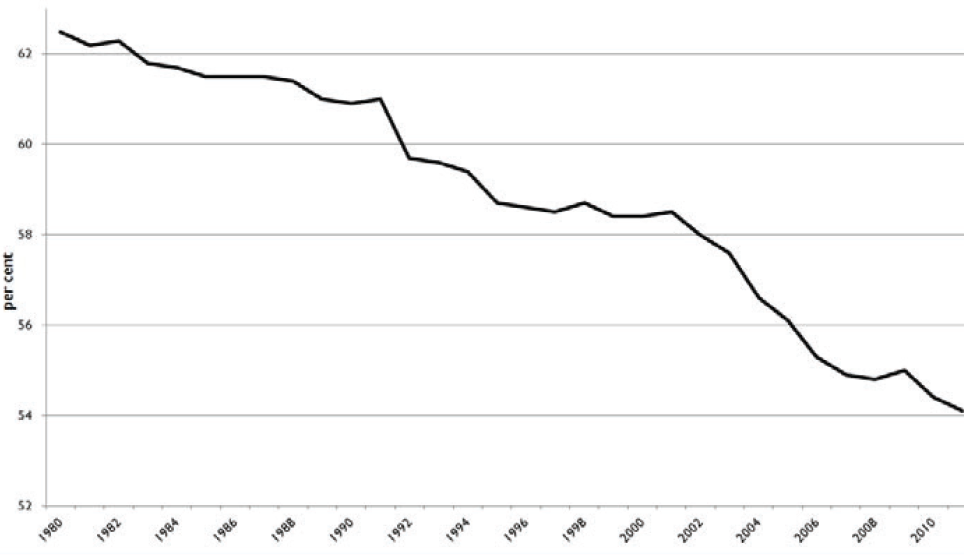

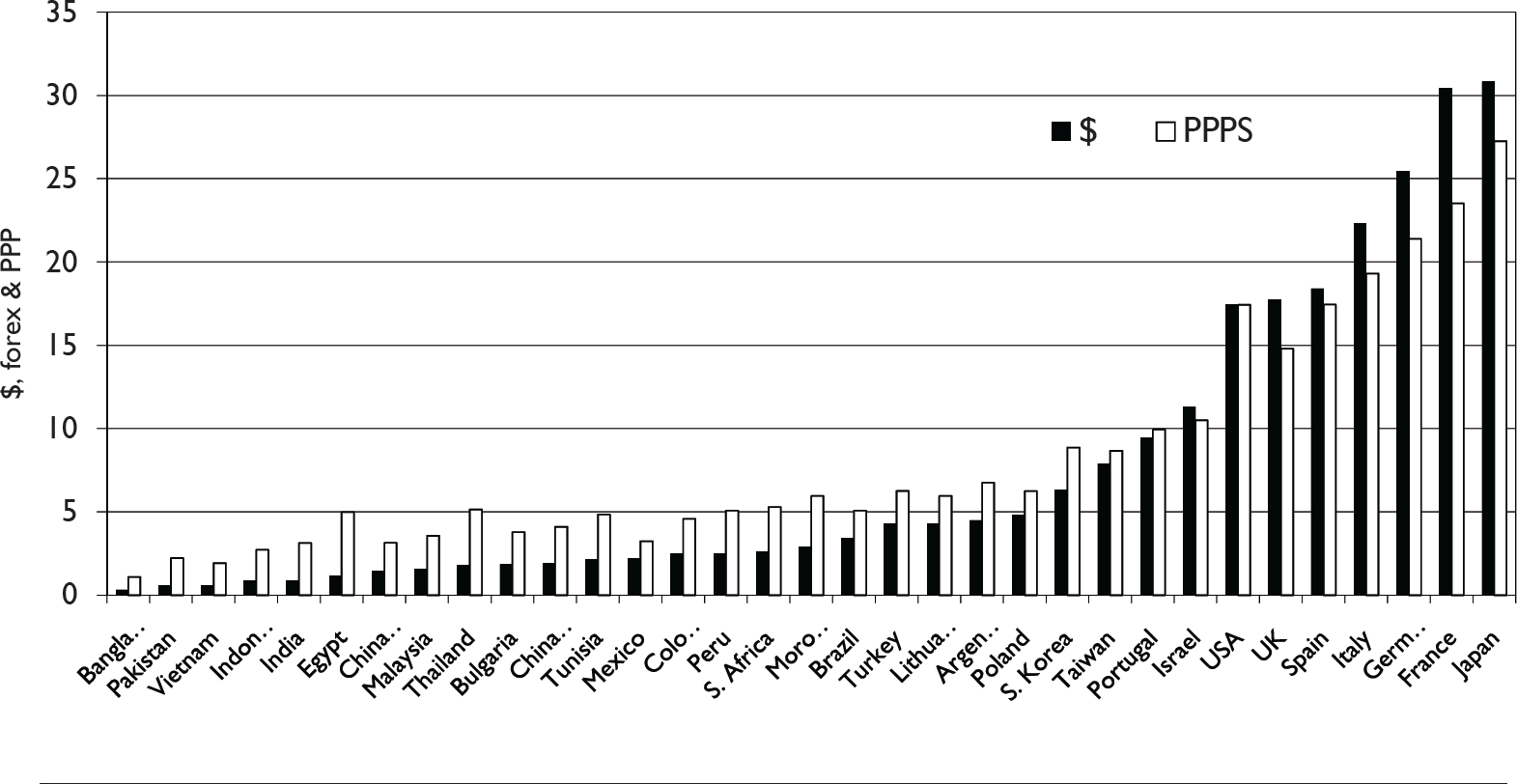

<small>3. GLOBAL WAGE DIFFERENTIALS AND THE MYTH OF CONVERGENCE</small>. As chapter 1 has revealed—and as chapters 2 and 3 will confirm—capitalists' lust for ultra-cheap labor-power is a fundamental determinant of the global shift of production. Chapter 5, "Global Wage Trends in the Neoliberal Era," attempts to bring global wage trends into focus, singling out three aspects for special attention: international wage differentials, growing in-country wage inequality, and the accelerating decline in labor's share of national income. Along the way, the accuracy and reliability of data on wages is questioned and found wanting, especially in low-wage countries. Calculation of real wages paid in domestic currency requires their conversion into "purchasing power parity"—adjusted dollars—thereby correcting for the failure of market exchange rates to equalize the purchasing power of "hard" and "soft" currencies. Since this adjustment is large and affects all international comparisons of wages, living standards and much else, it will be examined in some detail. | |||

<small>4. WAGES AND PRODUCTIVITY—GLARING PARADOXES THAT MAINSTREAM AND HETERODOX ECONOMIC THEORY CANNOT EXPLAIN</small>. Chapter 6, "The Purchasing Power Anomaly and the Productivity Paradox," marks a transition from the analysis of empirical data that preoccupies the first five chapters to the theoretical development and critique presented in chapters 7 to 9. Chapter 6 begins by asking why the purchasing power anomaly exists, discovering that two recurring themes of this book are centrally implicated: international differences in labor productivity (as conventionally defined and measured) and restrictions on the free international mobility of workers. As we discovered in chapter 1 and is further discussed in chapters 2 and 3, supposed international differences in labor productivity are used by mainstream economists and neoliberal apologists to explain and justify global wage differentials. This standard view, an ideological belief with little basis in empirical data, gives rise to a series of paradoxes and absurdities, for instance that the "productivity" of Bangladeshi garment workers is a tiny fraction of the European and North American workers who place the finished goods on shop shelves. Despite its central importance to neoliberal ideology, the "wage reflects productivity" argument has never been systematically criticized by heterodox and Marxist critics of neoliberalism. Examination of mainstream theories claiming to explain the purchasing power anomaly adds a further set of paradoxes and absurdities to this list. The remainder of chapter 6 identifies the source of the problem: the failure of ruling economic theory to distinguish between use-value and exchange-value, a distinction that is the very foundation of Karl Marx's theory of value. Thus the necessity for a reengagement with this theory is derived from analysis of empirical data and from the failure of mainstream economic theory to explain its key findings. | |||

<small>5. WAGE DIFFERENTIALS AND DIFFERENCES IN THE RATE OF EXPLOITATION</small>. The most important fact revealed by our analysis of three global commodities is the centrality of vast international wage differences in driving and shaping the global transformation of production during the neoliberal era. Chapters 2–6 analyze different dimensions of this, creating the basis for the development of a theoretical concept of it in chapters 7 and 8, in which international wage differentials are seen as a surface manifestation and distorted reflection of international differences in the degree of exploitation. Chapter 7, "Global Labor Arbitrage: Key Driver of the Globalization of Production," considers attempts by mainstream economists to understand the significance of wage-driven production outsourcing. Finding these to be, at best, purely descriptive, we turn to contemporary Marxist scholarship, and find this, with few but important exceptions, to be astonishingly indifferent to and accepting of bourgeois economists' argument that international wage differentials merely reflect international differences in labor productivity. The remainder of chapter 7 continues the quest for a concept of international differences in the rate of exploitation by visiting the debate on "dependency" that accompanied the anticolonial national liberation movements of the 1960s and 1970s, while chapter 8, "Imperialism and the Law of Value," completes the quest by testing the ability of Marx's theory of value, as presented in ''Capital''<nowiki/>'s three volumes, to explain the ancient and modern reality of super-exploitation. | |||

<small>6. HOW IMPERIALIST EXPLOITATION IS OBSCURED BY CONVENTIONAL INTERPRETATIONS OF ECONOMIC DATA</small>. Chapter 9, "The GDP Illusion," explains one of the most striking paradoxes revealed in the analysis in chapter 1 of the global commodity: commodities produced mostly or entirely in low-wage countries and consumed mostly or entirely in imperialist countries expand the GDP of the nations where they are consumed by far more than the GDP of the nations where they are produced. The source of this optical illusion is found in a fallacy that is at the heart of mainstream bourgeois economic theory and its heterodox variants: the tautological conflation of the value generated in production of a commodity with the price realized by its sale. | |||

<small>7. THE ORIGIN, NATURE, AND TRAJECTORY OF THE GLOBAL ECONOMIC CRISIS—WHY THE "FINANCIAL CRISIS" IS ROOTED IN CAPITALIST PRODUCTION</small>. The first nine chapters of this book analyze the defining transformation of the neoliberal era, namely the outsourcing and global shift of production. Chapter 10, "All Roads Lead into the Crisis," shows why this transformation, itself a response to the system-threatening crisis of the 1970s, prepared the ground for the reappearance of systemic crisis in 2007. Contrary to the economists' cozy consensus, this concluding chapter argues that this is a financial crisis in form only, and that no understanding of the origin, nature, and trajectory of the global economic crisis is possible unless it is seen as the inevitable result of explosive contradictions at the heart of globalized capitalist production. The chapter concludes by arguing that the current crisis is the most profound in the two centuries of capitalism's existence—and this is before we include, as we must, the added dimension of climate change, a euphemism for the capitalist destruction of nature. A decades-long economic depression, increasingly punctuated by wars and revolutions, is now unavoidable. There are two possible outcomes: either humanity resumes the transition to socialism inaugurated by the Russian Revolution one century ago, or it will descend into barbarism. | |||

== Outsourcing, or the Globalization of Production == | |||