More languages

More actions

No edit summary Tag: Visual edit: Switched |

No edit summary Tag: Visual edit: Switched |

||

| Line 1: | Line 1: | ||

{{Message box/Stub}} | |||

A '''tax''' is a compulsory financial levy on the purchase, sale, use, or ownership of a good, service, or income of an individual. It is the most common way for [[Market economy|market economies]] to fund their [[State|governments]]. Taxes have existed since ancient times and have been used in [[Slavery|slave]], [[Feudalism|feudal]], [[Capitalism|capitalist]], and [[Market socialism|market socialist]] societies. | A '''tax''' is a compulsory financial levy on the purchase, sale, use, or ownership of a good, service, or income of an individual. It is the most common way for [[Market economy|market economies]] to fund their [[State|governments]]. Taxes have existed since ancient times and have been used in [[Slavery|slave]], [[Feudalism|feudal]], [[Capitalism|capitalist]], and [[Market socialism|market socialist]] societies. | ||

Revision as of 17:39, 28 July 2023

| This article is a stub. You can help improve this article by editing it. |

A tax is a compulsory financial levy on the purchase, sale, use, or ownership of a good, service, or income of an individual. It is the most common way for market economies to fund their governments. Taxes have existed since ancient times and have been used in slave, feudal, capitalist, and market socialist societies.

By country

United States

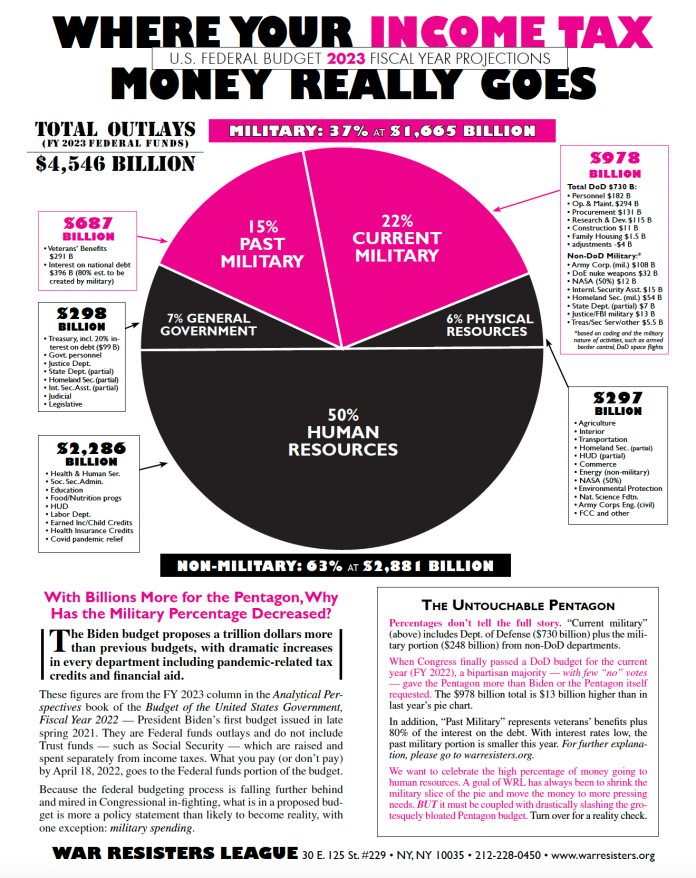

The U.S. federal government spent $4.546 trillion of money gained through income taxes in 2023. It spent 37% of the budget ($1.665 trillion) on the military, including $730 billion on the Department of Defense, $54 billion on the Department of Homeland Security, and $32 billion on nuclear weapons.[1]

References

- ↑ "Where Your Income Tax Money Really Goes" (2023). War Resisters League. Archived from the original on 2023-06-16.