mNo edit summary Tag: Visual edit |

(Capitalism vs. socialism) Tag: Visual edit |

||

| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

A '''tax''' is a compulsory financial levy on the purchase, sale, use, or ownership of a good, service, or income of an individual. It is the most common way for [[Market economy|market economies]] to fund their [[State|governments]]. Taxes have existed since ancient times and have been used in [[Slavery|slave]], [[Feudalism|feudal]], [[Capitalism|capitalist]], and [[Market socialism|market socialist]] societies. | |||

Under capitalism, taxes seriously reduce real [[Wage|wages]] for [[Proletariat|workers]]. [[Socialist state|Socialist countries]] usually have low taxes that are used to improve the economy and on social and cultural services.<ref name=":0">{{Citation|author=Economics Institute of the Academy of Sciences of the U.S.S.R|year=1954|title=Political Economy|chapter=Wages in Socialist Economy|chapter-url=https://www.marxists.org/subject/economy/authors/pe/pe-ch33.htm|page=|pdf=https://revolutionarydemocracy.org/archive/PoliticalEconomy.pdf|city=London|publisher=Lawrence & Wishart|mia=https://www.marxists.org/subject/economy/authors/pe/index.htm}}</ref> | |||

== By country == | |||

=== United States === | |||

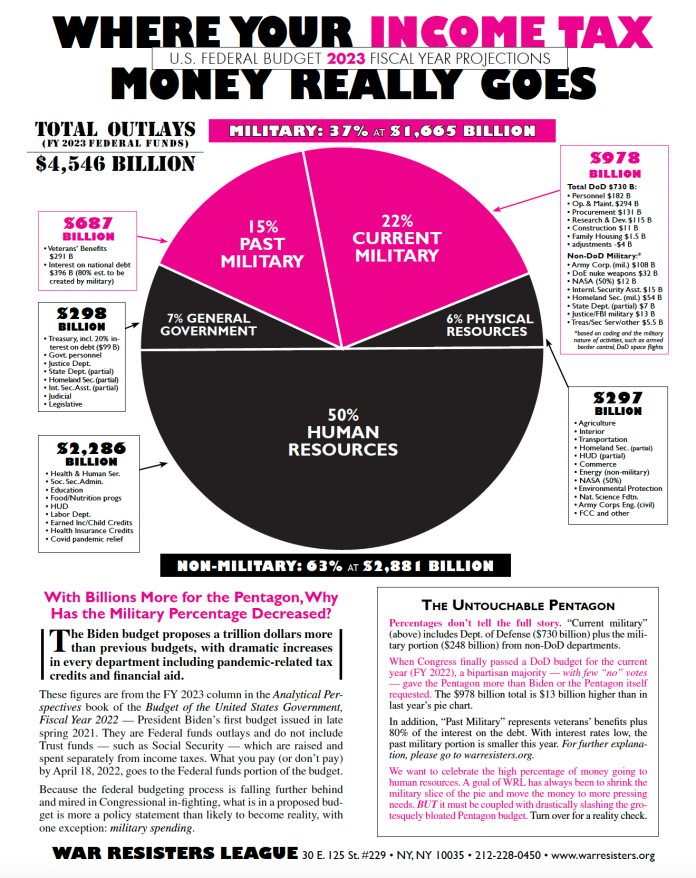

[[File:US tax pie chart.png|thumb|The [[United States of America|U.S.]] spends 37% of its federal budget ($1,655,000,000 per year) on war.]] | |||

The [[Government of the United States of America|U.S. federal government]] spent $4.546 trillion of money gained through income taxes in 2023. It spent 37% of the budget ($1.665 trillion) on the military, including $730 billion on the [[United States Department of Defense|Department of Defense]], $54 billion on the [[United States Department of Homeland Security|Department of Homeland Security]], and $32 billion on [[Nuclear weapon|nuclear weapons]].<ref>{{Web citation|newspaper=War Resisters League|title=Where Your Income Tax Money Really Goes|date=2023|url=https://covertactionmagazine.com/wp-content/uploads/2023/02/fy2023_pie_chart.pdf|archive-url=https://web.archive.org/web/20230616194639/https://covertactionmagazine.com/wp-content/uploads/2023/02/fy2023_pie_chart.pdf|archive-date=2023-06-16}}</ref> | |||

== References == | |||

[[Category:Stubs]] | [[Category:Stubs]] | ||

[[Category:Economics]] | [[Category:Economics]] | ||

Latest revision as of 12:17, 29 August 2023

A tax is a compulsory financial levy on the purchase, sale, use, or ownership of a good, service, or income of an individual. It is the most common way for market economies to fund their governments. Taxes have existed since ancient times and have been used in slave, feudal, capitalist, and market socialist societies.

Under capitalism, taxes seriously reduce real wages for workers. Socialist countries usually have low taxes that are used to improve the economy and on social and cultural services.[1]

By country

United States

The U.S. federal government spent $4.546 trillion of money gained through income taxes in 2023. It spent 37% of the budget ($1.665 trillion) on the military, including $730 billion on the Department of Defense, $54 billion on the Department of Homeland Security, and $32 billion on nuclear weapons.[2]

References

- ↑ Economics Institute of the Academy of Sciences of the U.S.S.R (1954). Political Economy: 'Wages in Socialist Economy'. [PDF] London: Lawrence & Wishart. [MIA]

- ↑ "Where Your Income Tax Money Really Goes" (2023). War Resisters League. Archived from the original on 2023-06-16.