More languages

More actions

Jucheguevara (talk | contribs) (created see also section) Tag: Visual edit |

(Graphs) Tag: Visual edit |

||

| (7 intermediate revisions by 4 users not shown) | |||

| Line 1: | Line 1: | ||

'''Inflation''' is the general increase in the prices of goods and services in an economy. This corresponds to the reduction in the purchasing power of money; | [[File:Food Price Index graph.png|thumb|Consumer Price Index in the United States since 2000]] | ||

'''Inflation''' is the general increase in the prices of goods and services in an economy. This corresponds to the reduction in the purchasing power of [[money]]; each unit of currency is able to buy less and less over time. | |||

Inflation can be caused by many factors, but it is most frequently seen in market-based [[Capitalism|capitalist]] economies. In [[Socialism|socialist]] economies, price levels are carefully regulated to ensure the proletariat has access to goods and services, but sometimes external factors can still lead socialist countries into inflationary crises. | Inflation can be caused by many factors, but it is most frequently seen in market-based [[Capitalism|capitalist]] economies. In [[Socialism|socialist]] economies, price levels are carefully regulated to ensure the [[proletariat]] has access to goods and services, but sometimes external factors can still lead socialist countries into inflationary crises. | ||

Inflationary periods harm the [[Poverty|poor]] and the [[Wage slavery|wage-earners]] far more than the [[Bourgeoisie|rich]], as the rich tend to be hedged against inflation through ownership of non-currency assets. | Inflationary periods harm the [[Poverty|poor]] and the [[Wage slavery|wage-earners]] far more than the [[Bourgeoisie|rich]], as the rich tend to be hedged against inflation through ownership of non-currency assets.<blockquote>"Under inflationary conditions, price rises exceed [[wage]] increases. This means that capitalist profits grow at the expense of a decreasing workers’ share in the national income. Inflation is a means of redistributing the national income in favour of the monopolies" | ||

– [[Otto Wille Kuusinen]]<ref>NEEDS PAGE NUMBER [https://static1.squarespace.com/static/5c4a567f4eddecfdf9c627a2/t/5d4a0d4d7b3fb6000145f957/1565134231835/Fundamentals+of+Marxism+Leninism.pdf Fundamentals of Marxism Leninism] by Foreign Languages Publishing House, Moscow 1963 ([https://twitter.com/juche0071/status/1537468523785736193?s=20&t=6OUsY36aOAm6yYhiGILl9w tweet source]) </ref></blockquote> | |||

== Impacts == | == Impacts == | ||

Inflationary episodes can cause economic instability especially among the poor, which sometimes further develops into social and political instability. | Inflationary episodes can cause economic instability especially among the poor, which sometimes further develops into social and political instability. | ||

== 2022 global inflation crisis == | Inflation generally prompts many central banks to raise the [[key interest rate]], which is the interest rate at which banks are charged for borrowing money from other banks, including central banks; this then increases the prime interest rate of banks, which is what people with loans (such as mortgages or credit card loans) must pay. | ||

The direct connection between raising interest rates and decreasing inflation is insubstantiated despite being a key tool in the toolbox of orthodox economists. What instead typically occurs is that raising interest rates puts so much pressure on the economy that it results in a recession, and that recession then generally (but not always) results in inflation decreasing. The concept of not inducing a recession while increasing interest rates to lower inflation - which is what orthodox economists predict should occur if their theory is correct - is called a "soft landing". There have been few soft landings in history because of the lack of understanding by orthodox economists of how economies actually function, but they continue to insist with each incoming recession that this will be the time when the soft landing finally happens. | |||

Another major assumption is that the increase of wages results in rising inflation, because stores will merely raise their prices alongside the increase in wages (in the absence of price controls) - this is called the [[wage-price inflationary spiral]]. While wage increases can sometimes be correlated to inflation, they can also have no correlation with inflation, or even be inversely correlated. Since the beginning of the 21st century, there has been little connection between wage increases and inflation.<ref name=":0">{{Web citation|author=Michael Roberts|newspaper=The Next Recession|title=Inflation: causes and solutions|date=2023-04-27|url=https://thenextrecession.wordpress.com/2023/04/27/inflation-causes-and-solutions/|archive-url=https://archive.ph/pGEPT|archive-date=2023-10-12|retrieved=2023-10-12}}</ref> | |||

== Socialist economies== | |||

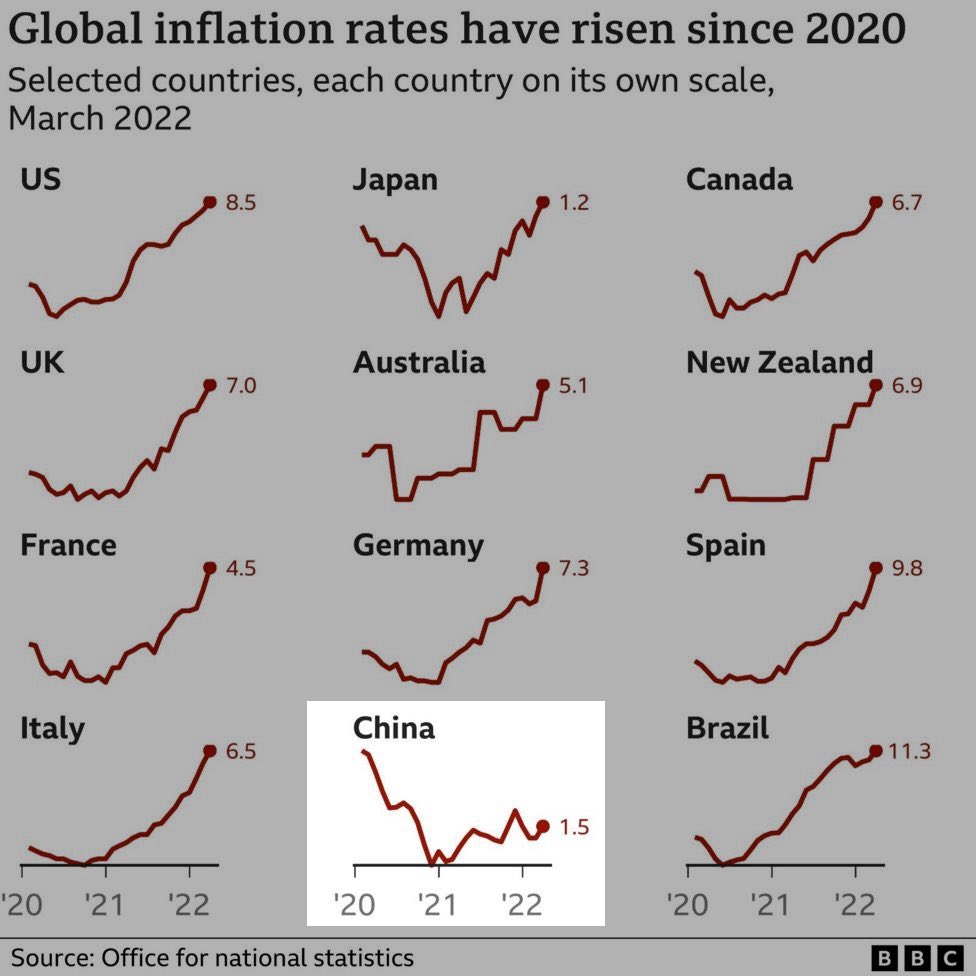

[[File:Inflation rates by country for 2022 crisis, China's low rate highlighted.jpg|thumb|China was one of the few countries to retain low inflation rates during the [[COVID-19 pandemic]]]] | |||

Social economies are far less affected by inflation than their capitalist counterparts. [[Post-Keynesian]] economists [[Joan Robinson]] and [[John Eatwell]] concede that “One clear and indisputable advantage of socialist industry over private enterprise is that it can continuously maintain a ‘high and stable level of employment’ without suffering from inflation.”<ref>{{Citation|author=E.L. Wheelwright (ed), Frank J.B. Stilwell (ed), Joan Robinson, John Eatwell|year=1976|title=Readings in Political Economy|chapter=Part Four: A Perspective on Socialist Economic Systems|section=Socialist Economies|page=238|quote=One clear and indisputable advantage of socialist industry over private enterprise is that it can continuously maintain a ‘high and stable level of employment’ without suffering from inflation.|city=Sydney|publisher=Australia and New Zealand Book Co.|isbn=0855520612|volume=2}}</ref> Additionally, this quote exposes the inability for a ‘high and stable level of employment’ to exist under capitalism without increases to inflation. | |||

Between 1960 and 1989, the [[German Democratic Republic (1949–1990)|GDR]] had an average annual inflation rate of 0.5% in the aggregate economy and 0% in consumer goods. Between 1980 and 1990, inflation in the aggregate economy was also 0%.<ref name=":05">{{Citation|author=Austin Murphy|year=2000|title=The Triumph of Evil|chapter=A Post-Mortem Comparison of Communist and Capitalist Societies Using the German Case as an Illustration|page=94|pdf=https://mltheory.files.wordpress.com/2017/06/austin-murphy-the-triumph-of-evil.pdf|city=Fucecchio|publisher=European Press Academic Publishing|isbn=8883980026}}</ref> | |||

==2022–2023 global inflation crisis== | |||

=== Causes and solutions === | |||

Many countries around the world, including both developed and developing countries, have and continue to experience a severe inflationary crisis. Contributing factors include the attempt by the [[Imperial core|West]] to isolate [[Russian Federation|Russia]] from the global markets thus driving up the scarcity and prices of goods, as well as rampant monetary expansion (commonly referred to as "money printing" although most new currency generated is digital, not physical in cash form).<ref>{{News citation|title=‘Breaking point’: soaring inflation drives cuts to hunger-relief programmes|date=2022-05-21|url=https://www.scmp.com/news/world/article/3178635/breaking-point-soaring-inflation-drives-cuts-hunger-relief-programmes?module=more_top_stories_int&pgtype=homepage}}</ref><ref>{{News citation|newspaper=MSN|title=Consumer confidence takes inflation hit|url=https://www.msn.com/en-us/money/markets/consumer-confidence-takes-inflation-hit/ar-AAXV7Tx}}</ref> | |||

Economists around the world have argued about what the causes of the inflation were - some claiming excessive demand to be the culprit, while others suggest that insufficient supply caused it - and how to best fix it. Marxist economist Michael Roberts has argued that supply chain issues caused inflation to rise, and his solution is public ownership of food and energy corporations throughout global supply chains.<ref name=":0" /> | |||

=== Impacts === | |||

In the United Kingdom, the chief economist of the Bank of England has said that people must accept that they are poorer, and stop asking for wage increases.<ref>{{Web citation|author=Michael Race and Vishala Sri-Pathma|newspaper=BBC|title=Bank of England economist says people need to accept they are poorer|date=2023-04-26|url=https://www.bbc.co.uk/news/business-65308769|archive-url=https://archive.ph/ifiOt|archive-date=2023-04-26|retrieved=2023-10-12}}</ref> | |||

==See also== | |||

*[[Hyperinflation]] | |||

==References== | |||

<references /> | |||

[[Category:Economic concepts]] | |||

Latest revision as of 18:56, 10 July 2024

Inflation is the general increase in the prices of goods and services in an economy. This corresponds to the reduction in the purchasing power of money; each unit of currency is able to buy less and less over time.

Inflation can be caused by many factors, but it is most frequently seen in market-based capitalist economies. In socialist economies, price levels are carefully regulated to ensure the proletariat has access to goods and services, but sometimes external factors can still lead socialist countries into inflationary crises.

Inflationary periods harm the poor and the wage-earners far more than the rich, as the rich tend to be hedged against inflation through ownership of non-currency assets.

"Under inflationary conditions, price rises exceed wage increases. This means that capitalist profits grow at the expense of a decreasing workers’ share in the national income. Inflation is a means of redistributing the national income in favour of the monopolies" – Otto Wille Kuusinen[1]

Impacts[edit | edit source]

Inflationary episodes can cause economic instability especially among the poor, which sometimes further develops into social and political instability.

Inflation generally prompts many central banks to raise the key interest rate, which is the interest rate at which banks are charged for borrowing money from other banks, including central banks; this then increases the prime interest rate of banks, which is what people with loans (such as mortgages or credit card loans) must pay.

The direct connection between raising interest rates and decreasing inflation is insubstantiated despite being a key tool in the toolbox of orthodox economists. What instead typically occurs is that raising interest rates puts so much pressure on the economy that it results in a recession, and that recession then generally (but not always) results in inflation decreasing. The concept of not inducing a recession while increasing interest rates to lower inflation - which is what orthodox economists predict should occur if their theory is correct - is called a "soft landing". There have been few soft landings in history because of the lack of understanding by orthodox economists of how economies actually function, but they continue to insist with each incoming recession that this will be the time when the soft landing finally happens.

Another major assumption is that the increase of wages results in rising inflation, because stores will merely raise their prices alongside the increase in wages (in the absence of price controls) - this is called the wage-price inflationary spiral. While wage increases can sometimes be correlated to inflation, they can also have no correlation with inflation, or even be inversely correlated. Since the beginning of the 21st century, there has been little connection between wage increases and inflation.[2]

Socialist economies[edit | edit source]

Social economies are far less affected by inflation than their capitalist counterparts. Post-Keynesian economists Joan Robinson and John Eatwell concede that “One clear and indisputable advantage of socialist industry over private enterprise is that it can continuously maintain a ‘high and stable level of employment’ without suffering from inflation.”[3] Additionally, this quote exposes the inability for a ‘high and stable level of employment’ to exist under capitalism without increases to inflation.

Between 1960 and 1989, the GDR had an average annual inflation rate of 0.5% in the aggregate economy and 0% in consumer goods. Between 1980 and 1990, inflation in the aggregate economy was also 0%.[4]

2022–2023 global inflation crisis[edit | edit source]

Causes and solutions[edit | edit source]

Many countries around the world, including both developed and developing countries, have and continue to experience a severe inflationary crisis. Contributing factors include the attempt by the West to isolate Russia from the global markets thus driving up the scarcity and prices of goods, as well as rampant monetary expansion (commonly referred to as "money printing" although most new currency generated is digital, not physical in cash form).[5][6]

Economists around the world have argued about what the causes of the inflation were - some claiming excessive demand to be the culprit, while others suggest that insufficient supply caused it - and how to best fix it. Marxist economist Michael Roberts has argued that supply chain issues caused inflation to rise, and his solution is public ownership of food and energy corporations throughout global supply chains.[2]

Impacts[edit | edit source]

In the United Kingdom, the chief economist of the Bank of England has said that people must accept that they are poorer, and stop asking for wage increases.[7]

See also[edit | edit source]

References[edit | edit source]

- ↑ NEEDS PAGE NUMBER Fundamentals of Marxism Leninism by Foreign Languages Publishing House, Moscow 1963 (tweet source)

- ↑ 2.0 2.1 Michael Roberts (2023-04-27). "Inflation: causes and solutions" The Next Recession. Archived from the original on 2023-10-12. Retrieved 2023-10-12.

- ↑ “One clear and indisputable advantage of socialist industry over private enterprise is that it can continuously maintain a ‘high and stable level of employment’ without suffering from inflation.”

E.L. Wheelwright (ed), Frank J.B. Stilwell (ed), Joan Robinson, John Eatwell (1976). Readings in Political Economy, vol. 2: 'Part Four: A Perspective on Socialist Economic Systems; Socialist Economies'. Sydney: Australia and New Zealand Book Co.. ISBN 0855520612 - ↑ Austin Murphy (2000). The Triumph of Evil: 'A Post-Mortem Comparison of Communist and Capitalist Societies Using the German Case as an Illustration' (p. 94). [PDF] Fucecchio: European Press Academic Publishing. ISBN 8883980026

- ↑ "‘Breaking point’: soaring inflation drives cuts to hunger-relief programmes" (2022-05-21).

- ↑ "Consumer confidence takes inflation hit". MSN.

- ↑ Michael Race and Vishala Sri-Pathma (2023-04-26). "Bank of England economist says people need to accept they are poorer" BBC. Archived from the original on 2023-04-26. Retrieved 2023-10-12.