Tendency of the rate of profit to fall: Difference between revisions

More languages

More actions

Jucheguevara (talk | contribs) (created page) Tag: Visual edit |

No edit summary Tag: Visual edit |

||

| (11 intermediate revisions by 5 users not shown) | |||

| Line 1: | Line 1: | ||

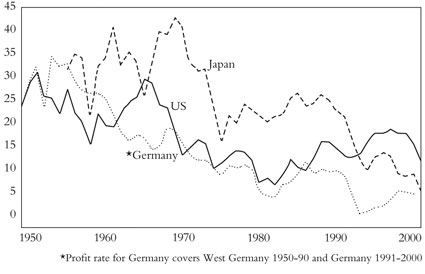

[[File:TRPF graph.png|thumb|Declining rates of profit in the [[United States of America|USA]], [[Japan]], and [[Federal Republic of Germany|Germany]] since 1950]] | |||

The '''tendency of the rate of profit to fall''' ('''TRPF''') is an empirical observation in political economy concerning the overall [[rate of profit]] of an economy, which tends to decrease over time. This is subject to discussion in [[crisis theory]]. The discussions on the causes of this tendency can be found in Chapter 13 of [[Karl Marx]]'s ''[[Library:Capital, vol. III|Capital, Volume III]],''<ref>It is also referred to by Marx as the "''law'' of the tendency of the rate of profit to fall" (LTRPF). As explained in the article, there are disputes about whether there is such a law or not. Other terms used include "the falling rate of profit" (FROP), the "falling tendency of the rate of profit" (FTRP), "decline of the rate of profit" (DROP), and the "tendential fall of the rate of profit" (TFRP). The average rate of profit on production capital is usually written as ''r'' = S / (C+V)</code>.</ref> but economists as diverse as [[Adam Smith]],<ref>{{Citation|author=[[Adam Smith]]|title=The Wealth of Nations|chapter=9}} See also {{Citation|author=[[Philip Mirowski]]|title=Adam Smith, Empiricism, and the Rate of Profit in Eighteenth-Century England.|series=History of Political Economy|volume=14|year=1982|page=178–198.}}</ref> [[John Stuart Mill]],<ref>{{Citation|author=[[John Stuart Mill]]|title=Principles of Political Economy|year=1848|chapter=4}} {{Citation|author=Bela A. Balassa|title=Karl Marx and John Stuart Mill.|journal=Weltwirtschaftliches Archiv|year=1959|page=147–165}} Bd. 83</ref> [[David Ricardo]]<ref>{{Citation|author=[[David Ricardo]]|title=Principles of Political Economy and Taxation|chapter=6}}. {{Citation|author=Maurice Dobb|title=The Sraffa system and critique of the neoclassical theory of distribution.}} In : {{Citation|author=E.K. Hunt & Jesse G. Schwartz|title=A Critique of Economic Theory|publisher=Penguin|year=1972|page=211–213}}</ref> and [[Stanley Jevons]]<ref>{{Citation|author=[[W. Stanley Jevons]]|year=1871|title=The Theory of Political Economy|city=Harmondsworth|publisher=Penguin Books|year=1970|page=243–244}}</ref> referred explicitly to the TRPF as an empirical phenomenon that demanded further theoretical explanation, although they differed on the reasons why the TRPF should necessarily occur.<ref>{{Citation|author=[[Tony Aspromourgos|Aspromourgos, Tony]]|title=Profits}}, in: {{Citation|author=James D. Wright (ed.)|title=International Encyclopedia of the Social & Behavioural Sciences|city=Amsterdam|publisher=Elsevier|year=2015, 2nd edition|volume=19|page=111–116}}</ref> Marx regarded the TRPF as proof that [[Capitalism|capitalist]] production could not be an everlasting form of production since in the end the profit principle itself would suffer a breakdown.<ref>{{Citation|author=[[Karl Marx]]|title=[[Capital, Volume III]]|journal=Penguin ed|year=1981|page=350 and 368}}</ref> | |||

This tendency is also a global phenomenon.<ref>{{News citation|title=A world rate of profit: important new evidence|url=https://thenextrecession.wordpress.com/2022/01/22/a-world-rate-of-profit-important-new-evidence/|date=2022-01-22|author=Michael Roberts}}</ref> In 2020, the US rate of profit continued its downward trend, leading to heightened crisis among the profit-seeking class (the [[bourgeoisie]])<ref>{{News citation|journalist=Michael Roberts|date=2021-12-05|title=The US rate of profit in 2020|url=https://thenextrecession.wordpress.com/2021/12/05/the-us-rate-of-profit-in-2020/|newspaper=|archive-url=|archive-date=|retrieved=}}</ref> | |||

== Source of TRPF == | |||

The [[General formula for capital|cycle of capital]] m->c->m' is reliant on [[labor-power]] (which is the special [[commodity]] that makes all [[Value|values]], not all [[wealth]]) to increase the value of commodities. But money has to buy more than labor-power, it has to buy/pay to maintain the tools, machines, raw materials and so on used by labor-power. So the costs of capital production are divided into two halves: [[Constant capital|constant]] and [[Variable capital|variable]] capital. The capital spent on workers is the variable capital. The most common form of variable is wages. Though it can take other forms such as food or health insurance. | |||

Capitalists have been highly successful in decreasing or keeping stagnant [[Real wage|real wages]] for the last 2-3 generations'''<<citation needed>>'''. As capitalist society is successful at suppressing variable capital costs, variable capital's impact on profit (remember profit = m' - m) is minimal. Where the tendency of the rate of profit to decline comes into play is due to constant capital. Machines and tools add value to commodities, but this is only value previously added by some prior humans that built those machines/tools. | |||

As capitalism drags on and develops technologically, more and more machines and tools are needed to produce commodities. The centralization of factories has made them increasingly reliant on autonomous technology for example. Thus the capital spending required for constant capital goes up. | |||

Why don't capitalists just use less constant capital? The answer is competition. Constant capital allows more commodities to be produced using the same amount of labor-power. Let us suppose that in the early days of pencil making, a single person operating a pencil workshop alone could produce 20 pencils in a day. So 8 in isolation could produce 160. Whereas 8 working in a factory, using far more expensive machines and tools, could produce 20,000 per day. Because these new machines and tools have decreased the [[Socially necessary labor time|amount of labor required]], the value of pencils, followed by their [[price]], falls. Putting out of business anyone who cannot make a profit off of the new cheaper pencils. | |||

As technology improves, more and more money must be spent on the latest and greatest industrial machines to avoid being beat out by a more up-to-date capitalist. | |||

== Counter-tendencies of TRPF == | |||

== See also == | == See also == | ||

| Line 7: | Line 21: | ||

* [[Crisis theory]] | * [[Crisis theory]] | ||

* [[Financial crisis]] | * [[Financial crisis]] | ||

== References == | == References == | ||

<references /> | |||

[[Category:Economic concepts]] | |||

Latest revision as of 08:57, 8 September 2023

The tendency of the rate of profit to fall (TRPF) is an empirical observation in political economy concerning the overall rate of profit of an economy, which tends to decrease over time. This is subject to discussion in crisis theory. The discussions on the causes of this tendency can be found in Chapter 13 of Karl Marx's Capital, Volume III,[1] but economists as diverse as Adam Smith,[2] John Stuart Mill,[3] David Ricardo[4] and Stanley Jevons[5] referred explicitly to the TRPF as an empirical phenomenon that demanded further theoretical explanation, although they differed on the reasons why the TRPF should necessarily occur.[6] Marx regarded the TRPF as proof that capitalist production could not be an everlasting form of production since in the end the profit principle itself would suffer a breakdown.[7]

This tendency is also a global phenomenon.[8] In 2020, the US rate of profit continued its downward trend, leading to heightened crisis among the profit-seeking class (the bourgeoisie)[9]

Source of TRPF[edit | edit source]

The cycle of capital m->c->m' is reliant on labor-power (which is the special commodity that makes all values, not all wealth) to increase the value of commodities. But money has to buy more than labor-power, it has to buy/pay to maintain the tools, machines, raw materials and so on used by labor-power. So the costs of capital production are divided into two halves: constant and variable capital. The capital spent on workers is the variable capital. The most common form of variable is wages. Though it can take other forms such as food or health insurance.

Capitalists have been highly successful in decreasing or keeping stagnant real wages for the last 2-3 generations<<citation needed>>. As capitalist society is successful at suppressing variable capital costs, variable capital's impact on profit (remember profit = m' - m) is minimal. Where the tendency of the rate of profit to decline comes into play is due to constant capital. Machines and tools add value to commodities, but this is only value previously added by some prior humans that built those machines/tools.

As capitalism drags on and develops technologically, more and more machines and tools are needed to produce commodities. The centralization of factories has made them increasingly reliant on autonomous technology for example. Thus the capital spending required for constant capital goes up.

Why don't capitalists just use less constant capital? The answer is competition. Constant capital allows more commodities to be produced using the same amount of labor-power. Let us suppose that in the early days of pencil making, a single person operating a pencil workshop alone could produce 20 pencils in a day. So 8 in isolation could produce 160. Whereas 8 working in a factory, using far more expensive machines and tools, could produce 20,000 per day. Because these new machines and tools have decreased the amount of labor required, the value of pencils, followed by their price, falls. Putting out of business anyone who cannot make a profit off of the new cheaper pencils.

As technology improves, more and more money must be spent on the latest and greatest industrial machines to avoid being beat out by a more up-to-date capitalist.

Counter-tendencies of TRPF[edit | edit source]

See also[edit | edit source]

References[edit | edit source]

- ↑ It is also referred to by Marx as the "law of the tendency of the rate of profit to fall" (LTRPF). As explained in the article, there are disputes about whether there is such a law or not. Other terms used include "the falling rate of profit" (FROP), the "falling tendency of the rate of profit" (FTRP), "decline of the rate of profit" (DROP), and the "tendential fall of the rate of profit" (TFRP). The average rate of profit on production capital is usually written as r = S / (C+V).

- ↑ Adam Smith. The Wealth of Nations: '9'. See also Philip Mirowski (1982). Adam Smith, Empiricism, and the Rate of Profit in Eighteenth-Century England.. History of Political Economy, vol.14 (pp. 178–198.).

- ↑ John Stuart Mill (1848). Principles of Political Economy: '4'. Bela A. Balassa (1959). Karl Marx and John Stuart Mill. (pp. 147–165). Weltwirtschaftliches Archiv. Bd. 83

- ↑ David Ricardo. Principles of Political Economy and Taxation: '6'.. Maurice Dobb. The Sraffa system and critique of the neoclassical theory of distribution.. In : E.K. Hunt & Jesse G. Schwartz (1972). A Critique of Economic Theory (pp. 211–213). Penguin.

- ↑ W. Stanley Jevons (1970). The Theory of Political Economy (pp. 243–244). Harmondsworth: Penguin Books.

- ↑ Aspromourgos, Tony. Profits., in: James D. Wright (ed.) (2015, 2nd edition). International Encyclopedia of the Social & Behavioural Sciences, vol. 19. Amsterdam: Elsevier.

- ↑ Karl Marx (1981). Capital, Volume III (pp. 350 and 368). Penguin ed.

- ↑ Michael Roberts (2022-01-22). "A world rate of profit: important new evidence"

- ↑ Michael Roberts (2021-12-05). "The US rate of profit in 2020"